Importing Existing Leave Balances

When bringing an existing employee over to Thankyou Payroll, you will have to input their existing leave balances. This article walks you through these calculations.

Updated: March 2024

When importing an existing employee, you will need to enter the following information:

- the employee's current leave balances (the focus of this article), and

- the employee's pay history to date (follow link to help article on this).

Entering the employee's leave balances will help the system accurately calculate leave entitlements, accrual and leave liability. Entering employee leave balances can be problematic when migrating from other systems. Their measurement used for the leave balance could be hourly, daily or weekly. This could mean additional calculations are needed to convert the different leave balances to days for our system. That is where this article makes things simple. Let's start.

- Calculating the existing annual leave balance

- Calculating the existing sick leave balance

- Calculating the existing alternative leave balance

Calculating the Existing Annual Leave Balance - Permanent Employee

In our system, a permanent employee is set up with the 'Rate as per the Holidays Act' leave setting. Let's take a look at preparing the existing annual holidays balance to be entered into Thankyou Payroll.

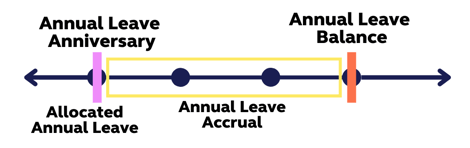

In our system, two figures make up an employee's annual leave balance:

- Days allocated annual leave: These are the minimum of 4 weeks of annual leave allocated on each leave anniversary, minus any leave taken in advance or cashed out.

- This can be a negative number if the employee has taken leave in advance since the last allocation on the anniversary date.

- Accrued leave: The 8% of the employee's gross earnings accrued since the last leave anniversary till now, when you are setting them up in our system.

If your previous system combined these figures into one, you need to separate them as they are entered in different areas in our system.

![]() Thankyou Payroll calculates allocated annual leave in days, so if your previous system calculated using hours or weeks you have to convert this into days. You do this using the employee's standard work pattern.

Thankyou Payroll calculates allocated annual leave in days, so if your previous system calculated using hours or weeks you have to convert this into days. You do this using the employee's standard work pattern.

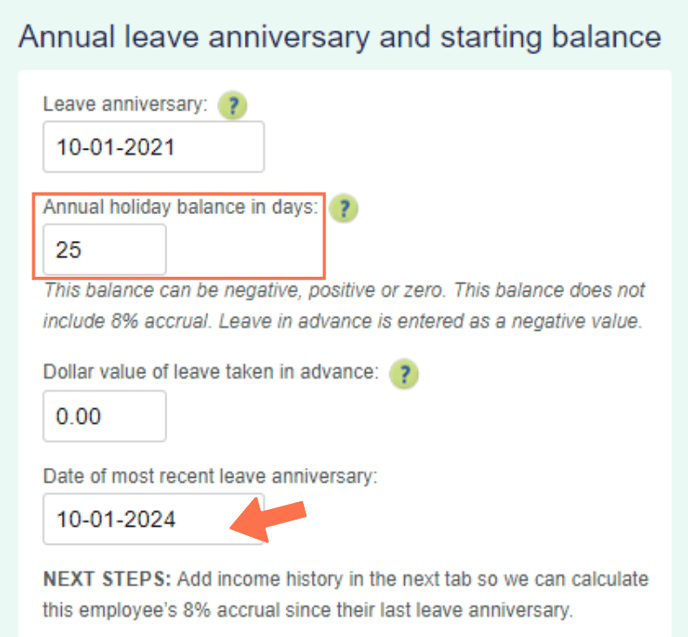

Let's look at a calculation example:

|

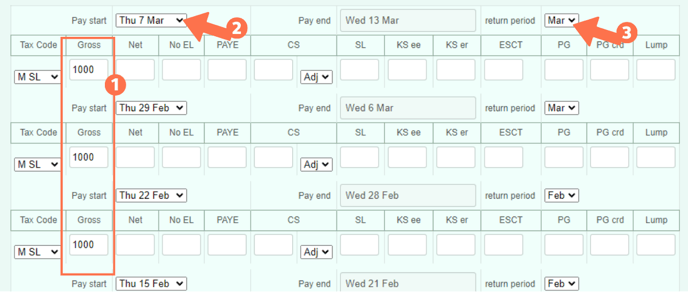

Your employee, Trish, has worked for you for the last 3 years as a permanent employee. She works 5 days a week, 8 hours a day. Her leave anniversary date is 10 January (start date: 10 Jan 2021). You are entering her in the Thankyou Payroll system on 10 March 2024. 1. Calculating allocated leave balance:

Complete the Leave tab of the Employee Profile as follows:

2. Now to calculate her annual leave accrual, which is the 8% of gross since the last leave anniversary we need her pay history.

|

|

We have created the following flow diagrams to help walk you through this process, step by step. Have a look: |

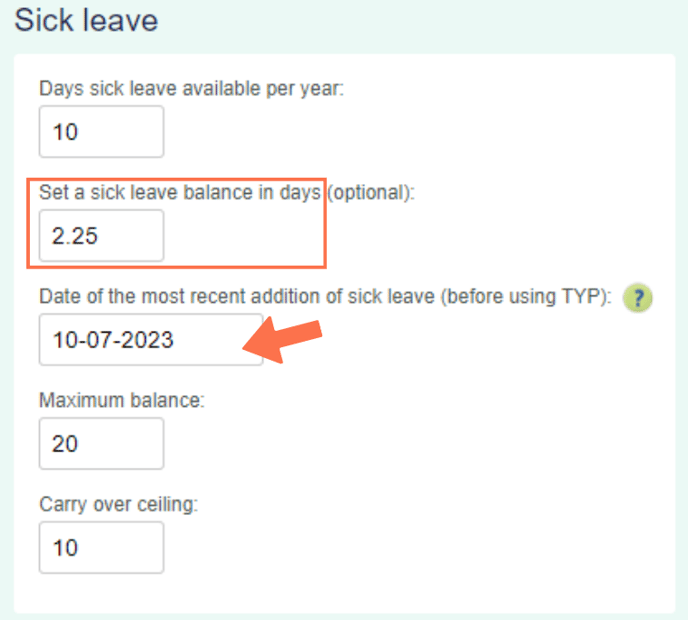

Calculating the Existing Sick Leave Balance

![]() The Thankyou Payroll system calculates the sick leave balance in days, so the existing leave balance should be entered as a day value in the Employee Profile.

The Thankyou Payroll system calculates the sick leave balance in days, so the existing leave balance should be entered as a day value in the Employee Profile.

If your previous system calculated sick leave in hours, the existing balance must be converted into a day value. This is done using the employee's regular work pattern.

Let's look at an example:

|

The payroll system you are migrating from calculates sick leave in hours. The employee's leave summary shows that Trish has an available balance of 18 hours of sick leave. You need to convert that into a day total for the Thankyou Payroll system. According to Trish's work pattern, she works 5 days a week at 8 hours per day. So your calculation will be:

Complete the Leave tab of the Employee Profile as follows:

|

|

This flow diagram will walk you through the steps, one at a time. |

Calculating the Existing Alternative Leave Balance

![]() The Thankyou Payroll system calculates the alternative leave balance in days, so the existing leave balance should be entered as a day value in the Employee Profile.

The Thankyou Payroll system calculates the alternative leave balance in days, so the existing leave balance should be entered as a day value in the Employee Profile.

If your previous system calculated alternative leave in hours, the existing balance must be converted into a day value. This is done using the employee's regular work pattern.

Let's look at an example:

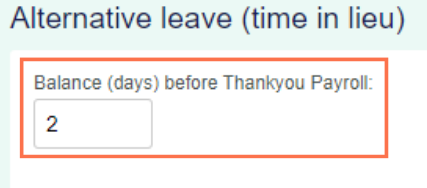

|

The payroll system you are migrating from calculates alternative leave in hours. The employee's leave summary shows that Trish has an available balance of 16 hours of allocated leave. You need to convert that into a day total for the Thankyou Payroll system. According to Trish's work pattern, she works 5 days a week at 8 hours per day. So your calculation will be:

Enter this balance in the Employee Profile:

|