Entering Previous Pay History for an Employee

When bringing an existing employee into the Thankyou Payroll system, you can enter their previous pay history so that their leave will calculate correctly. This article will show you how.

Updated: May 2024

When importing an existing employee, you will need to enter the following information:

- the employee's current leave balances (follow link to help article on this), and

- the employee's pay history to date (the focus of this article).

How to get to the Previous Pay History Tab

There are two easy ways to access the Previous Pay History Tab. They are as follows:

From the dashboard, go to Employees and select 'Previous Pay History' from the menu. Ensure that you are in the correct employee's profile, or select the employee from the 'your employee's' button.

From within the Employee Profile, you can also click on the 'history' tab and it will open the same previous pay history page.

Entering the Previous Pay History

For Thankyou Payroll to calculate the rate at which to pay annual leave as per the Holidays Act, we need the pay history up till the last anniversary date. As an alternative to this, some clients are happy to enter the average weekly rate manually for each individual leave calculation until the system has built up enough data to do this calculation from the pays run.

Pay History for a Casual Employee

Casual employees receive their leave paid out as PAYG with each pay, so their leave liability should be 0. Unless their leave setting changes and they become permanent employees, their pay history does not affect their leave calculations.

Bringing over an Employee with Minor Variation in Pay

If your employee has had only minor variations in pay for every pay period since their last leave anniversary before bringing them over to the Thankyou Payroll system, you can enter their gross only for this period. This is usually for a salaried or waged employee who gets paid the same amount each pay. If they have been with you for less than 12 months, enter the gross since their start date.

- Enter their full gross earnings amount since their leave anniversary (or since their start date) in the first line, as shown in this example.

- The pay start date is the day after the most recent leave anniversary (or their start date). Contact the Help Desk to set up this date if you do not have the option to choose a date that far back.

![]() Please contact the Help Desk to update the system if you input the Total Gross Earnings only. There are background settings we need to run to ensure the pay history is applied correctly.

Please contact the Help Desk to update the system if you input the Total Gross Earnings only. There are background settings we need to run to ensure the pay history is applied correctly.

Bringing over an Employee with a Variable Pay History

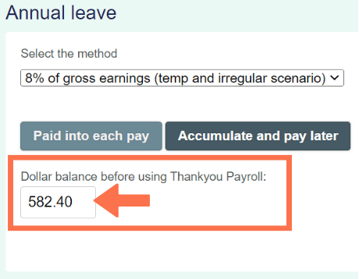

- If your employee is on the '8% of gross (temp and irregular scenario)' leave setting and has an accumulated balance before coming over to Thankyou Payroll, do not enter this in the History Tab. The balance brought over is entered in the Leave Tab of the Employee Profile, under the Annual Leave setting.

- If your employee is on the 'rate set as per the Holidays Act' leave setting and has had variable pay since their last leave anniversary, enter their gross pay history as far back as the last leave anniversary or start date.

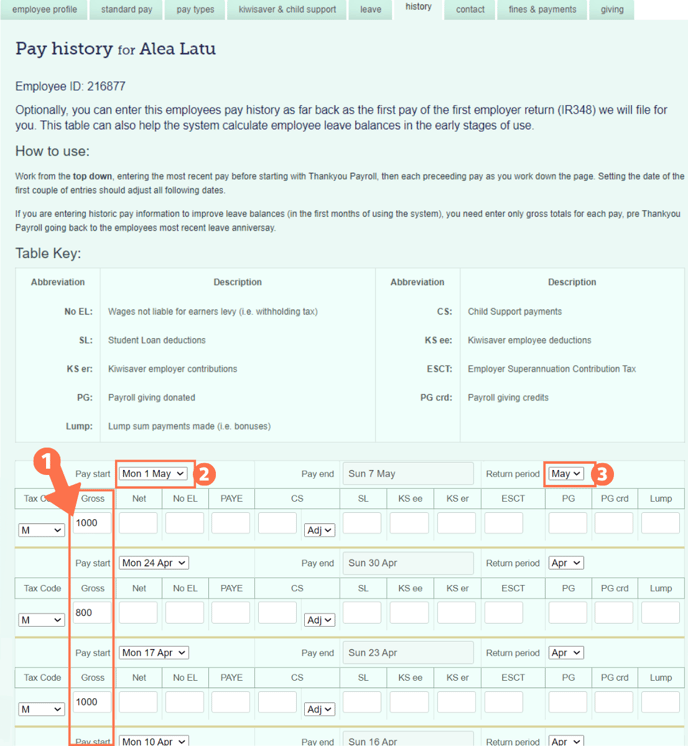

- Enter the gross amount for each pay into the box as per the example.

- Update the dates for each line to correlate with the pay period entered. There will be a line for each pay period going back to the last anniversary. Ensure that the last entry's 'pay start date' is the day after the anniversary date.

- Check that the return period month is correct. Update if needed.

![]() To calculate accrued leave and averages accurately, you will need to enter gross amounts for each pay going back to their leave anniversary before using this system. On rare occasions, you might need to fill in information for the complete 52 weeks.

To calculate accrued leave and averages accurately, you will need to enter gross amounts for each pay going back to their leave anniversary before using this system. On rare occasions, you might need to fill in information for the complete 52 weeks.

*Reach out to our Customer Success Team if you are unsure how far back you need to go.

Entering Complete Pay History - PAYE Returns

It is no longer necessary to fill in all the information on this page to complete PAYE Returns, even if you have started using Thankyou Payroll partway through a PAYE return period (calendar month).

All you have to do is provide the gross amounts as per the instructions above.

That is it! You have successfully completed the Pay History for your employee. Remember to SAVE!

.png?width=688&height=170&name=PayHistory_Gross%20(2).png)