Deducting Employee IRD Debt from Pay

When IRD advises you to make deductions from an employee's salary or wages, this has to be entered into the Thankyou Payroll System as soon as possible. Here is how to do this.

Updated: June 2023

If you receive a letter or notice from IRD in your MyIR account advising you to start making deductions from an employee's salary or wages you will need to enter this into the Thankyou Payroll system as soon as possible.

![]() The deductions will run until the amount has been settled, or IRD advises you in a letter to stop making the deductions. Follow this link to see how to stop making this deduction if so advised by IRD.

The deductions will run until the amount has been settled, or IRD advises you in a letter to stop making the deductions. Follow this link to see how to stop making this deduction if so advised by IRD.

Below is an example of a letter from IRD advising the employer to start making deductions from an employee's pay:

.png?width=618&height=641&name=IRD%20Deduction%20Notice%20(1).png)

Information to Note:

- The total amount owed is stated in the letter. You will input this amount in the timesheet as shown below. No further calculations are needed.

- This is a last resort arrangement, so cannot be stopped or changed by the employee's request. Any changes will be per instruction from the IRD.

- The reference number given in the letter is for direct deposit reference if not run through payroll. The employee timesheet is linked to the employee's IRD number, so the reference number is not needed when this is run through payroll.

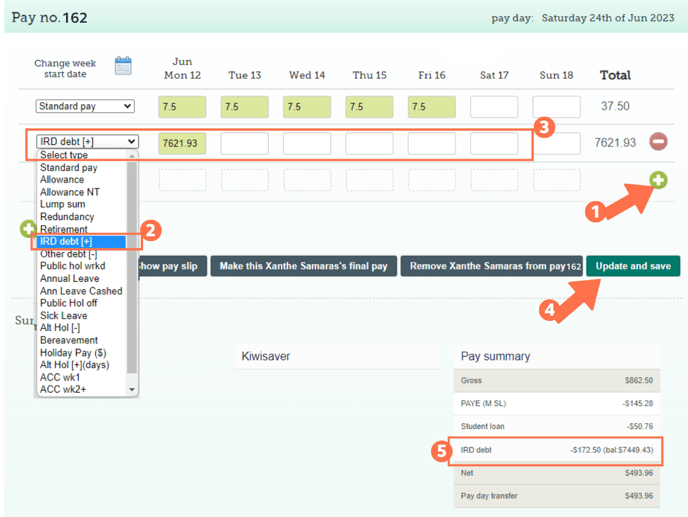

Entering IRD Debt on a Timesheet

IRD debt needs to be loaded into an active timesheet. Let's look at some options for doing this:

- If you already have an active pay on your dashboard you can use this and add the entry to their timesheet if this hasn't been processed yet, or

- create a new pay and add the employee to that pay.

![]() Pro Tip: You can enter this row in an empty timesheet with no 'standard pay row' added to it just to enter the deduction into the payroll system. The deduction start from the employee's next pay.

Pro Tip: You can enter this row in an empty timesheet with no 'standard pay row' added to it just to enter the deduction into the payroll system. The deduction start from the employee's next pay.

Once a pay is loaded, go to the employee's timesheet.

- Add a row to the timesheet by clicking on the green + sign.

- From the entry dropdown menu, select IRD debt (+) as the entry type.

- Enter the full amount owed in any of the timesheet boxes in that row. It doesn't have to be in a specific box.

- Update and Save the timesheet.

- Now you will see a new row added to the Pay Summary for IRD Debt.

- This row (number 5) will show the amount deducted from this timesheet as well as the remaining balance to be paid in brackets. NOTE: This balance is the total less the amount deducted from this timesheet.

![]() Please Note: You only have to add this to a single timesheet to load this deduction into the payroll system. The payroll system will automatically deduct the correct amount from future timesheets. You don't have to do anything further after processing the pay.

Please Note: You only have to add this to a single timesheet to load this deduction into the payroll system. The payroll system will automatically deduct the correct amount from future timesheets. You don't have to do anything further after processing the pay.

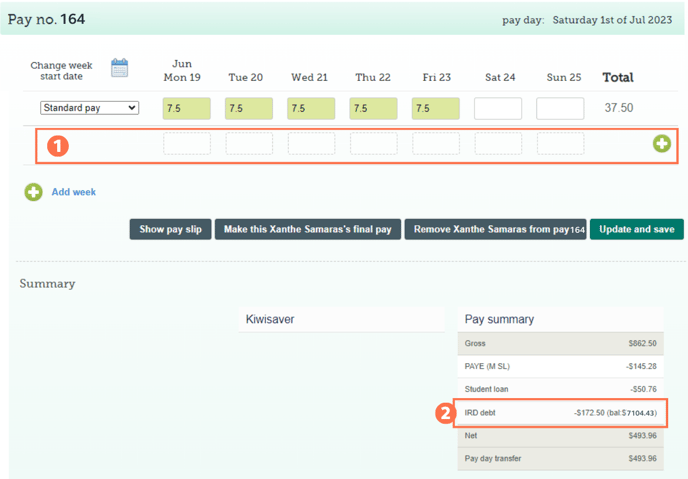

Here is an example of a later timesheet for this same employee:

- Note that the IRD debt (+) row is not included. DO NOT add it to the timesheet.

- The IRD debt summary is still displayed in the Pay Summary as this deduction is automatically included in the pay.

![]() This IRD debt pay summary line will display in EVERY timesheet for this employee until the debt is repaid, or the deduction is stopped.

This IRD debt pay summary line will display in EVERY timesheet for this employee until the debt is repaid, or the deduction is stopped.

Did you know? The system will automatically calculate the correct amount to deduct from the pay each pay period as set out by IRD guidelines. It will not deduct the full amount unless this amount is small.