Employee Student Loan Deductions

If an employee has a student loan to repay, the employer is required to make deductions from their income above the student loan repayment threshold. This article walks you through using different student loan deduction tax codes.

Updated: April 2024

![]() Student loan deductions are calculated and done by the system automatically based on the employee's tax code. They are not added manually to timesheets.

Student loan deductions are calculated and done by the system automatically based on the employee's tax code. They are not added manually to timesheets.

If your employee has a student loan, you must make deductions from their income if they earn above the student loan repayment threshold. This is done through their tax code - SL (for the standard deduction of 12%) or STC (special reduced deduction rate by arrangement). To find out more about updating an employee's tax code, follow the link to our dedicated article.

Regardless of the repayment threshold, student loan deductions are automatically made from a secondary income. Extra payments, such as regular bonuses are also liable for student loan deductions as they form part of the employee's Gross Taxable Income.

IRD will notify the employer when the employee's loan will be paid off in the next 3 pay periods. They could also request that the last loan payment amount be adjusted to clear the balance, and then to stop making student loan deductions. The employee's tax code must be updated when student loan deductions end.

Student Loan Repayment Threshold

The repayment threshold is updated annually on 1st April and applies to the employee's primary income. Secondary income is automatically liable for 12% student loan deductions on every dollar earned. The repayment threshold for FY24-25 is $24 128, so an employee will pay 12c on every dollar earned above this threshold.

Translated into pay periods, this threshold is:

- $464 if paid weekly

- $928 if paid fortnightly

- $2010.66 if paid monthly

Additional Student Loan Deductions

Compulsory Additional Deductions: SLCIR

You could be notified by IRD to make compulsory extra student loan deductions from an employee's pay. This is usually in the form of a debt amount to be recovered at the rate of 5%. This could be to recover a previous significant under-deduction of student loan repayments.

Where do I add this tax code?

Tax codes are updated in the employee's Employee Profile.

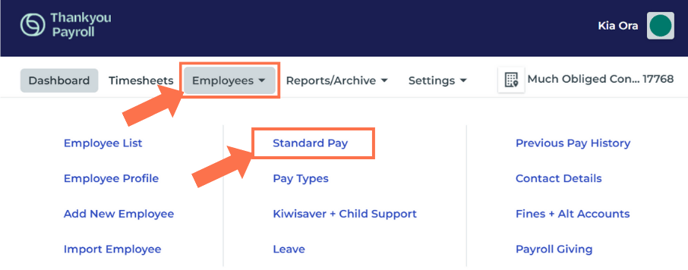

Go to 'Employees' and select 'Standard Pay' from the dropdown menu. Be sure to select the applicable employee from the employee list.

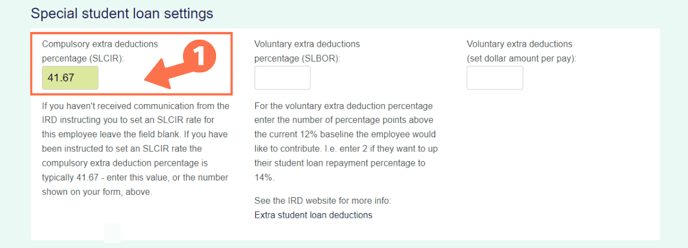

Scroll down to find the 'Special Student Loan Settings' area:

- In the first block, enter the percentage you have to deduct for the extra compulsory student loan repayment. This percentage is stated on the notice.

- Typically the percentage is an additional 5%, so you will enter this as 41.67 in the block. (5% of 12% is 41.67)

- Click 'Save' to update this setting.

- You do not enter the total amount of the shortfall in our system. IRD will instruct you when to stop making this extra deduction. To stop making this deduction, simply delete the entry in the block (blank block) and Save.

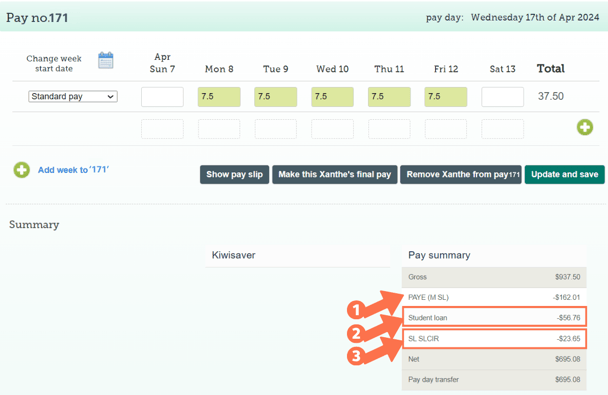

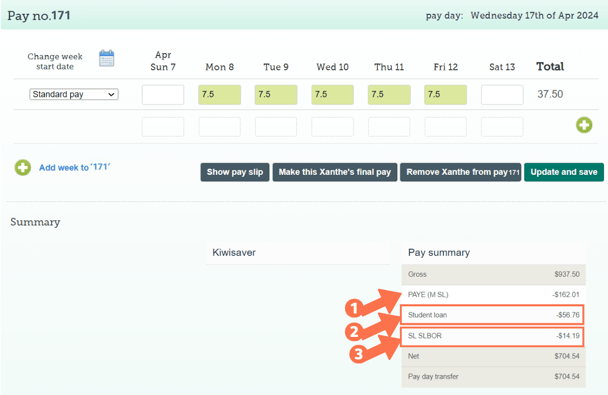

What will I see in the employee's timesheet?

When you update employee settings, an open timesheet on the dashboard will display the pay type 'Standard Pay (-1)' to show entries added before the updated setting. This pay type will not display in new timesheets created after updating employee settings.

- The PAYE tax code will be displayed as usual. This should end in SL.

- The regular student loan repayment will be calculated and displayed here.

- The usual rate is 12% for income above the threshold.

- The additional student loan deduction is displayed in a separate line, with the tax code SLCIR.

Voluntary Additional Deductions: SLBOR

Your employee may wish to make additional payments to their student loan. The tax code SLBOR is used for this as it enables these additional payments to be identified.

Things to note:

- This is voluntary, so the employee can start and stop these payments as they wish.

- As this is a voluntary deduction, the employee can choose the deduction to be

- This payment doesn't recognise the student loan threshold, so your employee can choose to make these payments even if they earn below the threshold. Use the fixed dollar amount option for employees who are below the repayment threshold as the system will not accept a percentage in this scenario.

|

Enter a fixed dollar amount with a voluntary additional deduction (SLBOR) for an employee who is earning below the repayment threshold. The system will not accept a percentage for this transaction. |

Where do I add this tax code?

Tax codes are updated in the employee's Employee Profile.

Go to 'Employees' and select 'Standard Pay' from the dropdown menu. Be sure to select the applicable employee from the employee list.

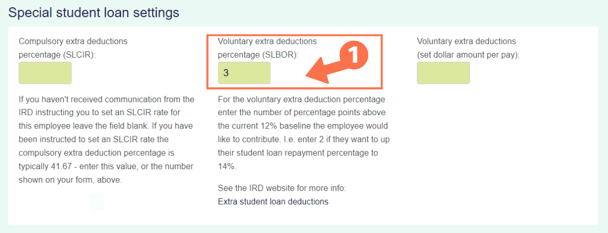

Scroll down to find the 'Special Student Loan Settings' area.

Adding SLBOR as a Percentage

The middle column under 'Special Student Loan Settings' is used to set a percentage voluntary deduction.

- In the middle block, enter the percentage the employee wants to deduct for the extra voluntary student loan repayment.

- This is extra to the ordinary contribution of 12% for income above the threshold.

- Only input the number. Do not use the % sign.

- Click 'Save' to update this setting.

- If the employee wishes to change this rate or stop contributions, simply update this number or delete it (blank box) as requested and save.

What will I see in the employee's timesheet?

When you update employee settings, an open timesheet on the dashboard will display the pay type 'Standard Pay (-1)' to show entries added before the updated setting. This pay type will not display in new timesheets created after updating employee settings.

- The PAYE tax code will be displayed as usual. This should end in SL.

- The regular student loan repayment will be calculated and displayed here.

- The usual rate is 12% for income above the threshold.

- If the employee earns below the threshold, this line will not display as there isn't a student loan deduction of 12% yet.

- The voluntary additional student loan deduction is displayed in a separate line, with the tax code SLBOR.

- This is calculated at the rate stated by the employee

- This will display even if the employee earns below the threshold.

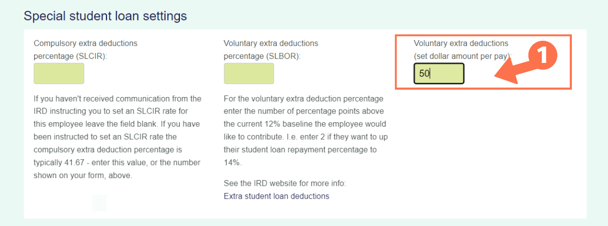

Adding SLBOR as a Fixed Dollar Amount

The last column under 'Special Student Loan Settings' is used to set a dollar amount per pay for the voluntary deduction.

- In the last block, enter the dollar amount the employee wants to deduct from each pay for the extra voluntary student loan repayment.

- This is extra to the ordinary contribution of 12% for income above the threshold.

- Only input the number. Do not use the $ sign.

- Click 'Save' to update this setting.

- If the employee wishes to change this amount or stop contributions, simply update this number or delete it (blank box) as requested and save.

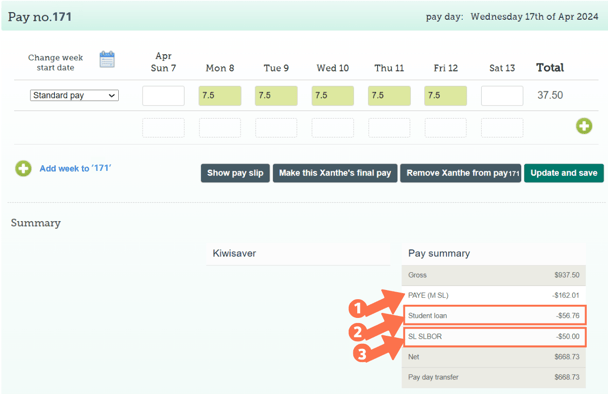

What will I see in the employee's timesheet?

When you update employee settings, an open timesheet on the dashboard will display the pay type 'Standard Pay (-1)' to show entries added before the updated setting. This pay type will not display in new timesheets created after updating employee settings.

- The PAYE tax code will be displayed as usual. This should end in SL.

- The regular student loan repayment will be calculated and displayed here.

- The usual rate is 12% for income above the threshold.

- If the employee earns below the threshold, this line will not display as there isn't a student loan deduction of 12% yet.

- The voluntary additional student loan deduction is displayed in a separate line, with the tax code SLBOR.

- This will be the amount stated by the employee

- This will display even if the employee earns below the threshold.