STC - Special Tax Codes

Special Tax Codes are awarded by the IRD for a specific timeperiod, usually relating to student loan repayments or/and PAYE tax rates. This article walks you through setting them up in the employee's profile.

Updated: January 2024

You may receive a letter/notice from the IRD to use a special deduction rate for an employee's student loan or tax. Your employee may also provide you with a certificate to this effect. This notice/certificate will be for a non-standard deduction and could include the following (examples only, not an exhausted list):

- to deduct the student loan repayments at a rate lower than the usual rate,

- to deduct no student loan repayments at all,

- to deduct PAYE at a special rate,

- to deduct no tax at all

Sometimes the notice or certificate can contain both a tax code and a special deduction rate for the employee's student loan. You use the STC tax code for these non-standard deductions.

NOTE: This is different to the standard notice to start making student loan deductions at the usual rate.

![]() STC, or Special Tax Code is a tailored tax code. IRD works out a tailored PAYE tax rate to suit individual circumstances. This tax code is for a specific period, whereafter the certificate must be renewed or an IR330 declaration be submitted.

STC, or Special Tax Code is a tailored tax code. IRD works out a tailored PAYE tax rate to suit individual circumstances. This tax code is for a specific period, whereafter the certificate must be renewed or an IR330 declaration be submitted.

How do I set this up?

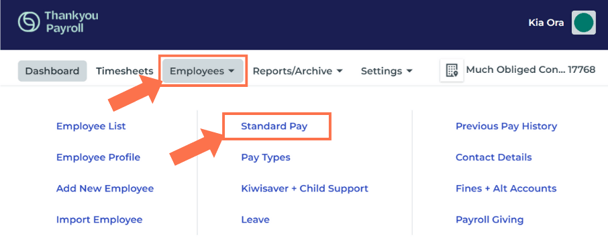

As this is a tax code, the update is done to the Employee's Profile.

Where to Change the Tax Code:

From the Dashboard, go to 'Employees' and select 'Standard Pay' from the dropdown menu. This will take you to the employee's Standard Pay tab, from where you can update their tax code.

Changing the Tax Code:

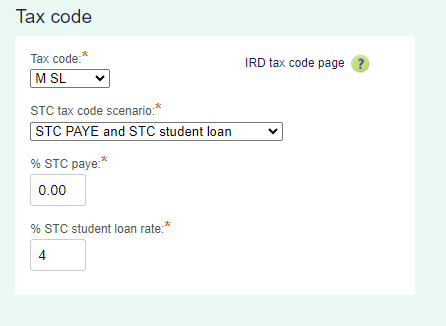

Next to the employee's standard pay, you will find the tax code dropdown menu with all the tax codes preloaded.

- Select 'STC' from the dropdown menu.

- In the next box, select the tax code option that applies based on the letter/certificate.

- The STC code can apply to either the student loan repayment or the PAYE calculation - or both.

- Fill in the percentage that is indicated on the letter from IRD or the certificate.

- These rates could be described as either a percentage or a dollar value in the letter/certificate, e.g. 4 cents per dollar (4%).

- Fill in the percentage only, without the % sign.

- If the deduction is to be Zero, fill in 0.00

- If the STC code applies to both student loan repayments and PAYE, you will see boxes for both as in the example below.

- NOTE that the Tax Code will show the underlying tax code as you enter the special rates in the fields or after you have saved the settings. This is correct.

- This will not stay STC, but show whatever the original tax code was. In this example, the employee was on M SL.

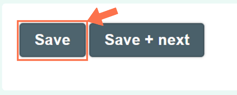

- Scroll down to the bottom of the page and click 'Save' to update this setting.

This employee's tax code has now been updated.

![]() Set yourself a reminder to update your employee's tax code on the end date specified in the letter from IRD, or on the certificate.

Set yourself a reminder to update your employee's tax code on the end date specified in the letter from IRD, or on the certificate.

![]() If you need to update the tax code in the middle of a pay period, follow this link to our help article full of useful tips.

If you need to update the tax code in the middle of a pay period, follow this link to our help article full of useful tips.

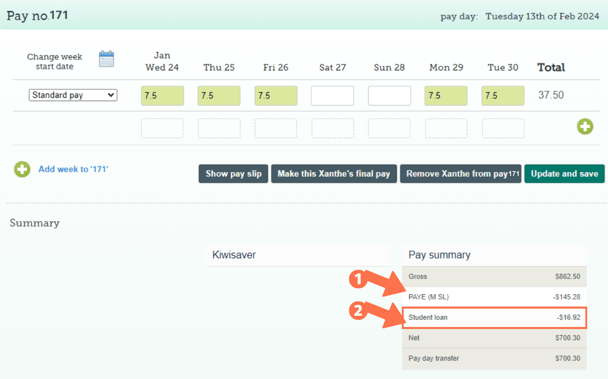

What will I see on the Timesheet?

When you update employee settings, an open timesheet on the dashboard will display the pay type 'Standard Pay (-1)' to show entries that were added before the updated setting. This pay type will not display in new timesheets created after updating employee settings.

- The PAYE tax code will display the base code, not STC. The special rate will be applied, so if you entered the rate as 0.00 the amount will be $0 on the timesheet.

- The student loan repayments will be calculated at the STC rate, if entered.

- If the student loan rate was set to 0.00, 'student loan' will not appear in the timesheet calculations or on the payslip.

![]() For more information on using STC codes, follow this link to the IRD website.

For more information on using STC codes, follow this link to the IRD website.

That is it! You have now added STC rates to your employee's tax calculations, easy as pie!

.png?width=608&height=468&name=STC_Employee%20Profile%20(2).png)