How to Sign Up to Thankyou Payroll

In this article, we'll guide you through the process of creating a Thankyou Payroll account.

Updated: February 2024

Creating an account is really simple. There is just one question you need to answer first - do you already have an account with Thankyou Payroll?

Click on your answer below and we'll take you to the information you need.

- No, this will be my first account with Thankyou Payroll.

- Yes, but I need to set up a separate account for another organisation.

Setting Up Your First Account

In order to set up your first account with Thankyou Payroll, you need to make sure that you are:

- registered with Inland Revenue as an employer, and

- you have a New Zealand bank account.

If you can tick off both of these things, head to the Thankyou Payroll website and click the 'Sign Up' button in the top right corner.

|

If you are a New Partner signing up your client's business on their behalf, you are in the right place to create your Thankyou Payroll login. Follow the steps in the article below.

|

* If you already have a Thankyou Payroll login and want to create a new client's account on their behalf, follow this link.

Creating your user profile

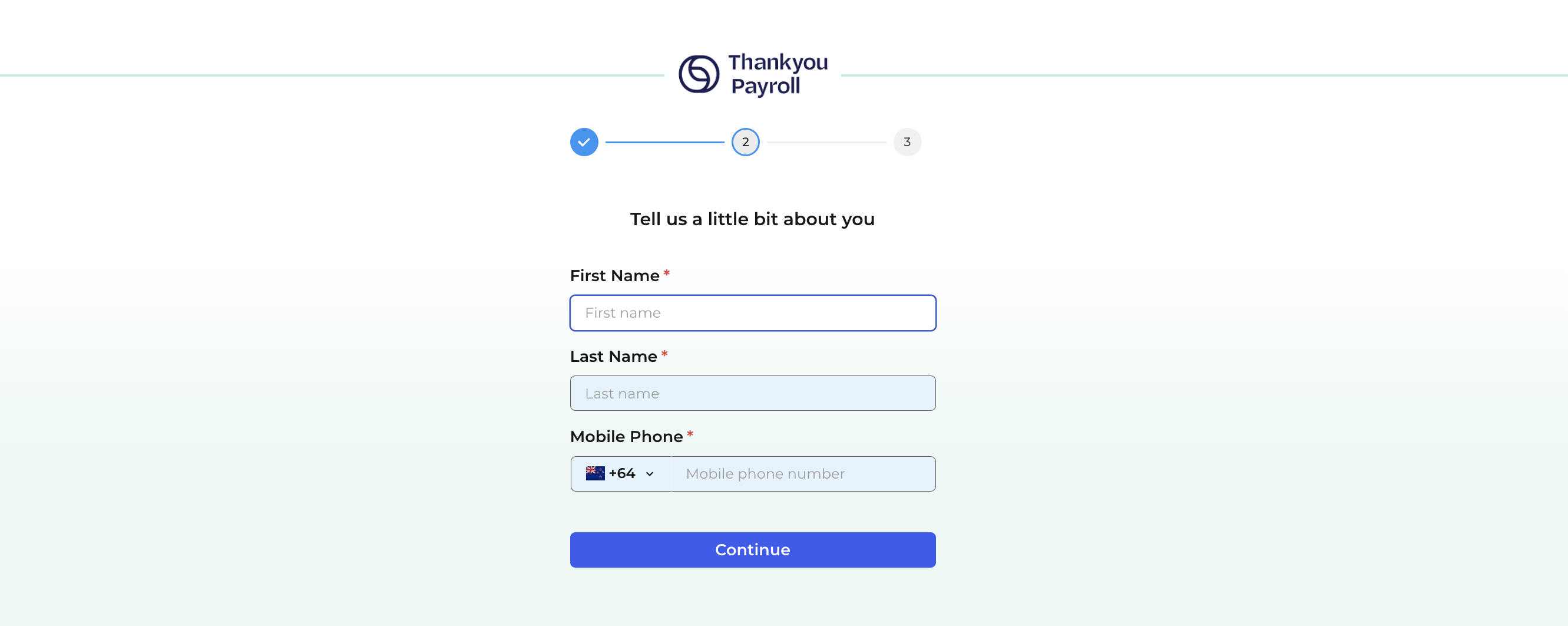

Once you've clicked 'Sign Up', you'll be taken to the first step of the sign up process - creating a user profile. The details you enter here will be what you'll use to log into Thankyou Payroll.

There are two ways to set up a profile. You can either;

- create your profile using your existing Google, Microsoft or Xero accounts, or

- create your profile from scratch using your email address.

Creating your profile with Google, Microsoft or Xero

Using Google, Microsoft or Xero adds an extra layer of security to your payroll account - plus it means you don't need to remember a separate password for your Thankyou Payroll log in.

You'll be asked to select which account to connect to Thankyou Payroll. Then enter your password and agree to the terms - it's that simple.

Creating your profile from scratch

If you create your profile from an email address, there will be a few extra steps to follow.

1. The first of those is to enter your email address.

2. You'll then be asked to create a password. To make your profile as secure as possible, the password must meet certain criteria in order to be accepted. If it doesn't meet all parts of the criteria, you'll be told so that you can adjust your password accordingly.

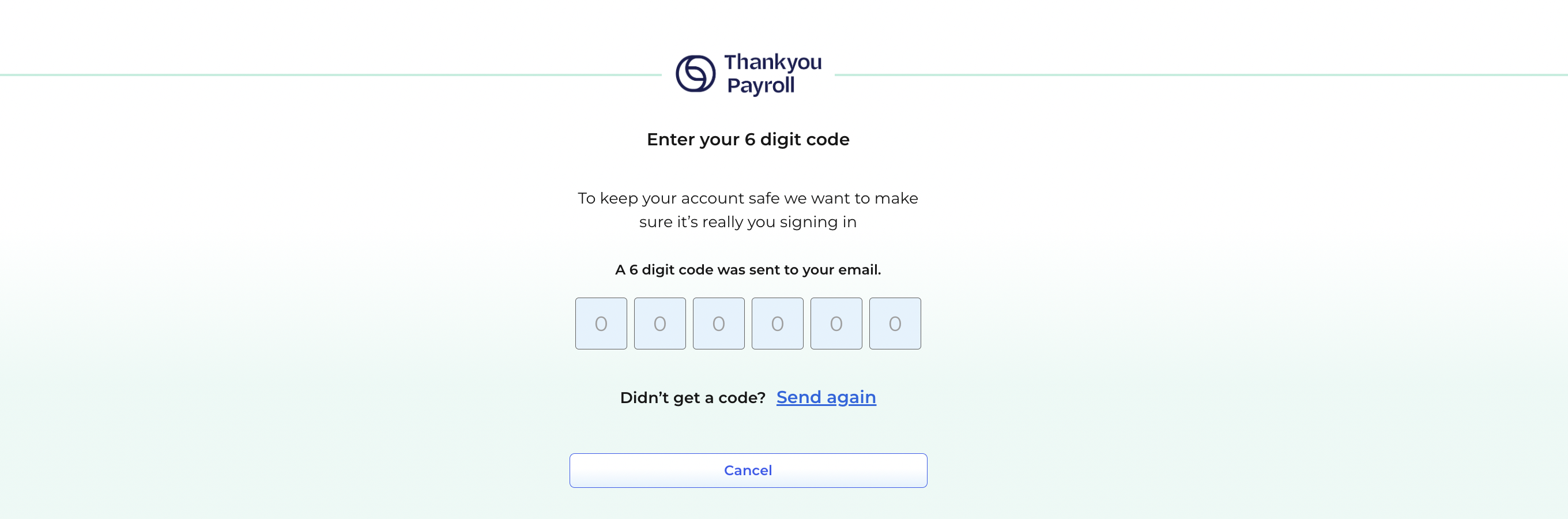

4. To ensure we have your correct details and the details you've entered belong to you, we'll send a six digit code to your email address. You'll need to enter this code to authorise the creation of your user profile with your username. This code will be valid for 15 minutes.

5. Creating your organisation account

-

Once your user profile has been created, you'll then be asked to enter the details of your organisation.

-

If you have registered as a Company you can enter your NZBN - which will pull through your details from the Companies Office.

-

If you are not a Company click the "I don't have an NZBN" to enter your business details manually.

6. Once your organisation's details have been entered.

-

You will be prompted to Authorise us to become your IRD intermediary, should you run a pay with us, by clicking the next button

We would love to know how you found out about us and reward you and your contact, so please take a moment to let us know.

Your account has now been created.

You will now be taken to set up your employees and get ready for your first pay.

Remember to also check that your employees details are completed in order to successfully file pay data with the IRD.

![]() If you are a partner creating an account on your client's behalf, you need to add the client as a New User to the payroll account so they can manage their payroll.

If you are a partner creating an account on your client's behalf, you need to add the client as a New User to the payroll account so they can manage their payroll.

Setting Up An Additional Account

If you already have an existing account with Thankyou Payroll, it's super easy to create an account for another business. This account will automatically be linked to your existing user profile so that you don't have multiple usernames for different accounts.

To create an additional account, log into your existing Thankyou Payroll account. On the dashboard click on 'Other Businesses' and select 'Add Account' from the drop down menu.

![]() If you have more than one payroll account linked to your user profile, you can manage and access these accounts via your Manage Accounts Dashboard. You can also create additional accounts from this dashboard.

If you have more than one payroll account linked to your user profile, you can manage and access these accounts via your Manage Accounts Dashboard. You can also create additional accounts from this dashboard.

You'll be redirected to the sign up page where you'll be asked to enter the details of your organisation. You can simplify this step by entering your NZBN - which will pull through the organisation's details from the Companies Office.

If you don't have or don't know the NZBN, you can choose to enter the details manually.

If the new business is not a Company click the "I don't have an NZBN" to enter your business details manually.

You will be prompted to Authorise us to become the IRD intermediary, when the first pay is processed, by clicking the next button

Enter your details or Referral Code to claim the first month free of fees for the new business.

You are now ready to set up the employees and run the first pay.

![]() If you are a partner creating an account on your client's behalf, you can now add the client as a New User to the payroll account so they can manage their payroll.

If you are a partner creating an account on your client's behalf, you can now add the client as a New User to the payroll account so they can manage their payroll.