Removing an IRD Debt Deduction from an Employee Account

When IRD advises you to stop making a deduction from an employee's pay, this is how you update the system.

Updated: June 2023

You could receive a letter or notice from IRD in your MyIR account advising you to stop making deductions for debt from an employee's salary or wages. You will need to update the Thankyou Payroll system as soon as possible to prevent further deductions from your employee's account.

![]() The deductions will run automatically until the amount has been settled, or you update the system to stop this deduction.

The deductions will run automatically until the amount has been settled, or you update the system to stop this deduction.

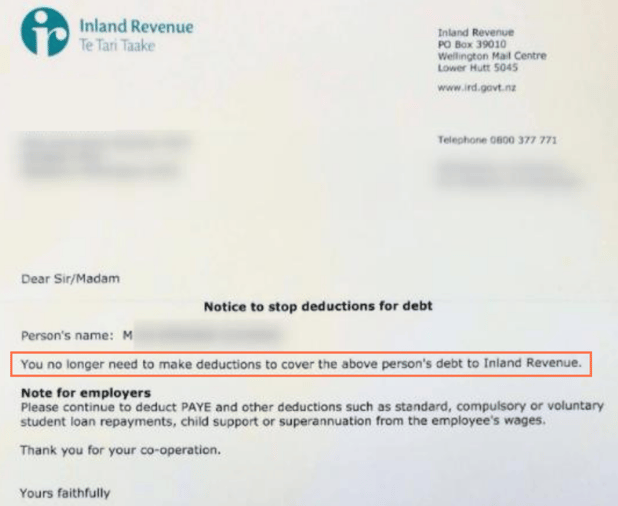

Below is an example of a letter from IRD advising the employer to stop making deductions for debt from an employee's pay:

Information to Note:

- Only act to stop deductions for IRD debt if so advised by the IRD. This is a last-resort arrangement, so cannot be stopped or changed upon the employee's request.

- The balance will not be provided in the letter. You must delete the rolling balance on the employee's payroll record to stop a debt deduction. The next section of this article will show you how to do this.

Removing the IRD Debt Deduction from the Timesheet

For the system to update the employee record on IRD debt, the stop order needs to be loaded into an active timesheet with a standard pay row. Let's look at some options for doing this:

- If the original timesheet where you've entered the debt in the IRD (+) row has already been processed, you need to add this stop order to the employee's next timesheet.

- If you already have an active pay on your dashboard with an open timesheet for this employee, you can use this and add the entry to their timesheet.

![]() Pro Tip: Sometimes the IRD letter to stop debt deductions comes days after the order to start said deduction before the pay has been processed.

Pro Tip: Sometimes the IRD letter to stop debt deductions comes days after the order to start said deduction before the pay has been processed.

If the original timesheet you entered the IRD (+) line on is unprocessed and still in the pay on your dashboard, simply open this timesheet and delete the IRD (+) line. Update and Save the timesheet.

This example will show you how to remove an IRD debt deduction after it has been processed and activated. Follow the steps below to get all the information you need to remove this deduction.

![]() By entering this stop order, no funds will be taken from the employee's pay for IRD debt. This entry will only balance out the debt on the payroll system.

By entering this stop order, no funds will be taken from the employee's pay for IRD debt. This entry will only balance out the debt on the payroll system.

- In the employee timesheet, make sure that there are entries for 'Standard Pay'. This is needed to generate the 'Pay Summary' with the correct 'IRD debt line' (2).

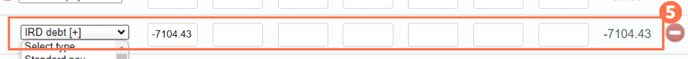

- Use the information in the IRD debt line to calculate the rolling balance in the payroll system as follows:

- Amount included in this timesheet (a) + balance left after this timesheet (b) = rolling balance in the payroll system.

In this example the calculations are as follows:

172.50 + 6931.93 = 7104.43- Add a row to the timesheet by clicking on the green + sign.

- From the entry dropdown menu, select IRD debt (+) as the entry type.

- Enter the negative value of the rolling balance as calculated (e.g. -7104.43) in any of the timesheet boxes in that row. It doesn't have to be in a specific box.

- Update and Save the timesheet.

- You will notice that the IRD debt line (2) in the Pay Summary will now have disappeared. It will not show in future timesheets as this debt has now been removed from the system.

Keep the IRD debt (+) entry line with the balanced total in this timesheet to process in the pay so this transaction can be finalised.

Please do not remove this line from the timesheet.

![]() Please Note: You are deleting the rolling balance from the payroll system, so this has to be the correct amount calculated and it has to be a negative amount to cancel the balance out.

Please Note: You are deleting the rolling balance from the payroll system, so this has to be the correct amount calculated and it has to be a negative amount to cancel the balance out.

You have successfully updated the employee record to delete the IRD debt from their payroll account.

What if the IRD debt line stays in the Pay Summary?

If the IRD debt line remains in the Pay summary with a balance shown, the system was not updated correctly. Please contact our Customer Success Team for assistance as soon as you notice this error.

.png?width=608&height=453&name=IRD%20Debt%20Stopped%20(1).png)