Registering as an Employer with the IRD

Just as you had to register your business to operate, you also have to register as an employer with the IRD to employ people. Let's look at how to do this.

Updated: October 2023

Registering your business is different to being registered as an employer.

- Registering your business with the IRD provides your business with a tax number (business IRD number), which identifies your business for all its tax-related events.

- When you decide to employ people - even if it is only one person (e.g. your spouse/partner, or your child) - you have to register as an employer with the IRD so you will be able to fulfil your legal obligations such as making PAYE deductions from your employee's pay.

![]() After submitting the online employer registration, you will see an EMP (payroll) tax type in your myIR account. All your employment-related records will be filed under this new tax type.

After submitting the online employer registration, you will see an EMP (payroll) tax type in your myIR account. All your employment-related records will be filed under this new tax type.

How do I register as an employer?

The easiest way is to fill the form in online through your business's myIR account. This is a legal form, so should be completed fully and correctly.

If you need more information about this, here is a link to the IRD website page.

Where to find the Employer Registration Form

- Log into your business's myIR account.

- Go to the 'I want to...' menu

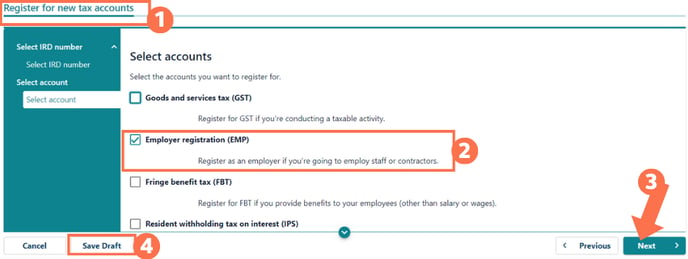

- Select 'Register for new tax accounts' and select your business IRD number

- Select the 'Employer Registration (EMP)'

- Click the green 'Next' button in the bottom right corner to start filling in the form.

- A useful feature to note is that you can save a draft of your form if you are unable to complete it all in one sitting. Simply click on the 'Save Draft' button in the bottom left of the screen.

When you have filled in the form completely, simply click the 'submit' button and you have registered as an employer!

That is it! You have completed your employer registration with the IRD and can start running pays.