The Quick Reports Function

The Quick Reports function offers some of the most often-used reports, already set up for you to access. This article will show you what information is included in each Quick Report.

Updated: November 2023

What are 'Quick Reports' used for?

The Quick Reports function houses nine of our most frequently used report types. The reporting fields are pre-set for your convenience. This serves to save you time and effort. They are also a great way to access data quickly if customisation is not needed.

Simply select 'Export' to generate the CSV export which can be opened in Excel or imported into your accounting software.

![]() Quick Reports do not have customisation, other than specifying employees to include in the date range selected.

Quick Reports do not have customisation, other than specifying employees to include in the date range selected.

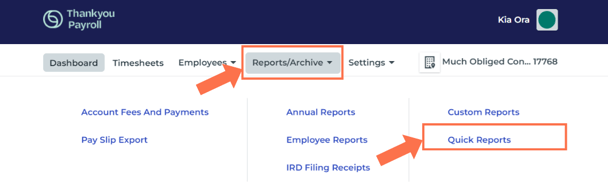

Accessing the Quick Reports Function

From the Dashboard, go to Reports/Archive and select 'Quick Reports' from the dropdown menu. This will take you to the Quick Reports page, from where you can generate specific reports to meet your needs.

Running a Quick Report

Click on an explore button to learn more:

Other Ways of Accessing Quick Report Data

If you need non-standard reports, you can generating a Custom Report to meet your needs, which can be exported as a CSV file.