Adding a Public Holiday Worked and Alternative Leave Earned to a Timesheet

This article will explain how to add the hours an employee worked on a public holiday and their alternative leave allocation to their timesheet.

Updated: July 2023

![]() The hours an employee works on a public holiday, as well as their alternative leave day allocation form part of your employee's Leave and Time Record that must be kept for a minimum of 7 years.

The hours an employee works on a public holiday, as well as their alternative leave day allocation form part of your employee's Leave and Time Record that must be kept for a minimum of 7 years.

- The minimum entitlement for working on a public holiday is 'time and a half', meaning 1.5x standard pay rate for every hour worked. This is for all employees, including casual employees.

- If the public holiday falls on an otherwise working day, the employee is entitled to a full day of alternative leave.

*Follow this link to a practical example of this and a quick recap video.

How to add the Hours Worked on a Public Holiday to a Timesheet

From the start date of employment, all employees are entitled to receive 1.5x their standard pay for every hour worked on a public holiday, regardless if it is their otherwise working day or not. This applies to casual employees as well.

Permanent and fixed-term employees are entitled to receive a full day of Alternative Leave, also called Alternative Holidays when they work any number of hours on a public holiday that falls on a day they would otherwise have been working. If they do not usually work on the day in question, they are still paid time-and-a-half for every hour worked but do not receive a day of alternative leave for working on the public holiday.

In this example, the employee works Mondays to Fridays so the public holiday falling on a Friday is on their otherwise working day.

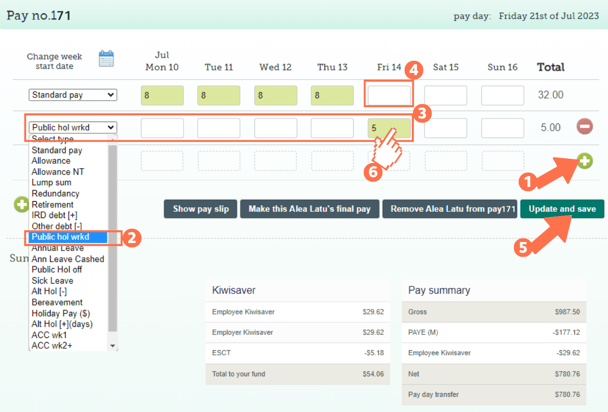

There are two parts to add to a timesheet for working on a public holiday. Part 1: Let's look at how to add the actual hours worked.

- Add a new row to the timesheet by clicking on the green + sign.

- Select the payment type: 'Public Hol wrkd' from the dropdown menu on the left of this row.

- For the public holiday, fill in the number of hours the employee worked for the day in question. Note: These are the actual hours the employee worked on the public holiday. These hours will be paid at 1.5x their standard pay rate.

- Adjust the 'Standard Pay' row entry for the corresponding day. Ensure that you remove any entries for this day's box to ensure that the employee is not paid twice for the same day.

- Update and Save this timesheet. The timesheet boxes will be green when the timesheet has been saved, as in the example.

- To check that the public holiday is being calculated at the expected rate, left-click in the green timesheet box for that entry. For a walkthrough on how to check this cost calculation, follow this link.

This is the first part of the timesheet entries done and where you would stop if the employee is not entitled to receive a full day of Alternative Leave.

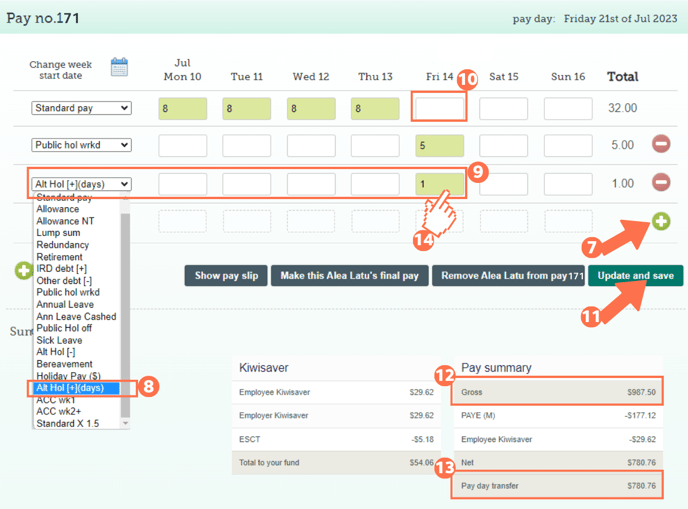

Part 2: Let's look at adding alternative leave gained to this timesheet to complete our public holidays worked timesheet:- Add a new row to the timesheet by clicking on the green + sign.

- Select the payment type: 'Alt Hol [+](days)' from the dropdown menu on the left of this row.

- Fill in a number 1 in this row for any public holiday worked that they are receiving their alternative holiday entitlement for. Note: Each entry in this row adds 1 day to the employee's alternative leave balance to be used later.

- Double check that the 'Standard Pay' row entry for the corresponding day is empty.

- Update and Save this timesheet. The timesheet boxes will be green when the timesheet has been saved, as in the example.

- Check the 'Gross balance' for the pay period to ensure that this is correct.

- The 'Pay day transfer' amount is what the employee will receive in their bank account.

- The cost calculations for alternative leave will be done when this leave is taken. When left-clicking in the green timesheet box for that entry, you will see a zero value for this entry.

That is it! You have now successfully loaded the hours your employee has worked on a public holiday and their day of alternative leave to their timesheet.

![]() If you are unsure whether your employee should receive a day of alternative leave, check the Employment New Zealand website. They also have a useful otherwise working day calculator.

If you are unsure whether your employee should receive a day of alternative leave, check the Employment New Zealand website. They also have a useful otherwise working day calculator.

What about penal rates or special rates?

A penal rate is an agreed special rate for working a specific type of day, for example a weekend or a public holiday. If you have a penal rate agreement with your employee, you have to calculate which rate will be the greater pay for working on the public holiday and pay them accordingly. Employees are not entitled to time-and-a-half on top of penal rates. It is either the penal rate, or the Holidays Act rate of 1.5x relevant daily pay, whichever is the greater.

Penal Rates can be set up as payment types in the Employee Profile. If this is the greater pay, do not use the 'Public Hol wrkd' payment type in the timesheet, but use the Penal Rate you set up for this agreement. The day of alternative leave will still be added as illustrated in this article.