Checking the Calculations for Cashing Up Alternative Leave in a Permanent Employee's Timesheet

This article will show you how to check that the alternative leave cashed up is done at the agreed rate and that the number of days deducted from the balance is correct.

Updated: August 2023

When you cash up alternative leave in a timesheet you can check the value of what that leave is paid at by clicking in the entry field of the timesheet. This will also show how many days are deducted from the employee's alternative leave balance for that timesheet entry. Take care that the employee's alternative leave balance is not over-deducted, e.g. 1.5 days instead of 1 day.

Follow this link for a quick reminder of how to cash up alternative leave in your employee's timesheet.

- In your saved timesheet (with green boxes), left-click in the entry field of the alternative leave hours to access the calculation data for that entry. Scroll down to find the cost tracking information below the timesheet.

- This line shows the value of the alternative leave to be paid out for this entry. Note that different days could have different values based on your employee's work pattern, i.e. they work fewer hours on certain days. Make sure that the hours entered are what has been agreed to be used for this payment.

- In this example, this line shows that for the entry clicked (Alt Hol (-) on Friday 14 July) a total of $ 200 will be paid out for the hours entered in the timesheet. Meaning: this entry is worth $ 200 to the employee.

- This shows the ordinary hours the system recognises as a typical day for this particular day, i.e. a typical Friday.

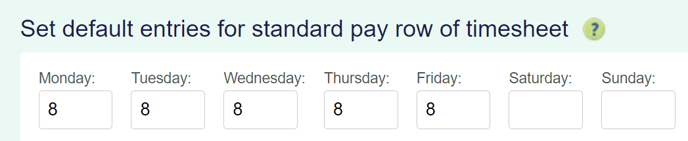

- In this example, a full work day on a Friday is 8 hours long based on the Employee Profile.

- If the hours per day have not been set in the Employee Profile, the system will calculate the hours by dividing the week's total hours by the number of days worked.

- If by agreement, a different number of hours must be used to constitute a day for this payment, change this number to the agreed hours.

- The system will automatically default to paying alternative leave at the relevant daily pay rate. If this is the agreed calculation, keep this setting toggled on.

- If the agreement was to cash up using average daily pay, toggle this setting on.

- This number is very important to check. This shows how many days or part days will be deducted from the employee's alternative leave balance for this entry. Make sure that this number is not more than a day if they are only cashing up one day of leave. It can be part of a day, e.g. 0.5 (half a day), 0.25 (quarter of a day) etc.

Checking calculations if cashing up more than 1 day:

- In your saved timesheet (with green boxes), left-click in the entry field of the alternative leave hours to access the calculation data for that entry. Scroll down to find the cost tracking information below the timesheet.

- This line shows the value of the alternative leave to be paid for this entry. Make sure that the hours entered are what was agreed to be used for this payment.

- In this example, this line shows that for the entry clicked (Alt Hol (-) on Friday 14 July) a total of $ 400 will be paid for the hours entered in the timesheet, which is the value of 2 days of alternative leave. Meaning: this entry is worth $ 400 to the employee.

- This shows the ordinary hours the system recognises as a typical day for this particular day, i.e. a typical Friday.

- In this example, a full work day on a Friday is 8 hours long based on the Employee Profile.

- If the hours per day have not been set in the Employee Profile, the system will calculate the hours by dividing the week's total hours by the number of days worked.

- If the agreed number of hours to count as a day for this transaction is different, enter the number of hours that would count as one full day in this box.

- The system will automatically default to paying out alternative leave at the relevant daily pay rate. Keep this toggled on if that was the rate agreed to.

- If the agreement was to pay at the average daily rate, toggle on this calculation here.

- This number is very important to check. This shows how many days or part days will be deducted from the employee's alternative leave balance for this entry. Make sure that this number is correct. If not, you can manually correct it here.

Helpful things to note:

If all the fields look right, but the total number of days deducted from the alternative leave balance (point 6) and/or the value paid for the day (point 1) is wrong, follow this link to an article showing you how to update your timesheet correctly. The article uses Annual Leave as an example, but the same steps should be followed to update the background calculations in any malfunctioning timesheet.