How do I Set Up a Young Employee in the System?

Setting up an under-20-year-old employee in the payroll system requires the same fields completed as regular employee setup, but there are slightly different laws to comply with. This article gives you useful tips and links to information.

Updated: October 2024

In this article:

- Useful things to note when employing a young person

- Example of a young employee's Employee Profile setup

- Showing the employee's age on their payslip (as leave and time record)

- Example of a young employee's timesheet and payslip

- Useful links and further resources

What do I need to know about employing a young worker

There are some special things to note when employing someone under the age of 18.

- Young employees must have an IRD number, Tax Code declaration and Employment Agreement - the same as any employee.

- When employing someone under the age of 20 years of age, the employer must record the employee's age on their leave and time record.

- Minimum wage

- There is no minimum wage for employees under the age of 16

- Between 16-19 years, young employees can be paid a starting-out wage, if this applies. The latest rates can be found here.

- KiwiSaver - Follow this link to our help article showing this setup.

- Employer Contributions only become compulsory when the employee turns 18 y/o

- If the employee (under 18 y/o) has voluntarily joined KiwiSaver, their deductions can be made from their wages.

- The employee has the option to either voluntarily contribute to their KiwiSaver directly, or have you deduct this directly from their wages.

- If under 18 y/o, they have to apply directly with the KiwiSaver Scheme provider. Their parents might need to sign them up. If signed up, they still have to provide the employer with a KS2 stating the contribution rate.

- Restrictions to hours worked apply

- When employing school-aged children (under 16), their work hours must be outside of school hours AND not between 10 pm and 6 am

- A certificate of exemption must be supplied to override this rule

- There are restrictions to where a young employee may work and the type of work they are allowed to do.

Employee Profile Setup

To comply with showing the employee's age on their leave and time record, we suggest adding this as a custom pay type to their employee profile.

Let's have a look at setting up a young employee:

- Enter the employee's name as it is recognised by IRD.

- Adding the employee's age in the Name Field in their Employee Settings will show the employee's age on their timesheet and payslips, but this will cause problems with their payday filing as IRD doesn't recognise any additions to name fields as this will not correspond with their records.

- The minor employee should have their own IRD number and not use their parent or another person's number.

- The employee should have their own bank account details.

- Do not enter their age in this field, as it will not show on their payslip. This reference is only for bank transactions and will appear on the bank statement only.

- This email address is where the payslip will be sent. The employee should provide their own email address.

- Update and Save the information before moving on to the next tab.

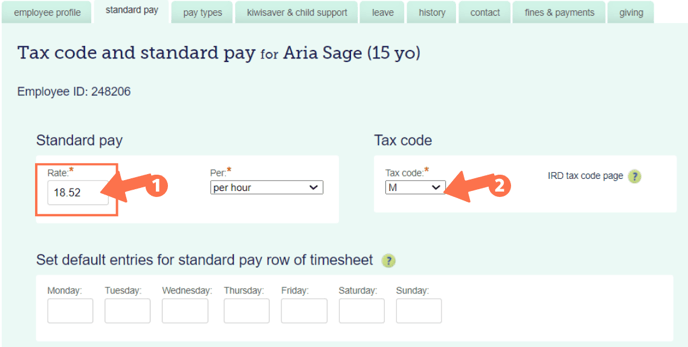

Note: Their Standard Pay Tab

The employee's pay rate could be lower than the Adult Minimum Wage if they are receiving the starting- or training wage.

This tax code should be as supplied in the employee's tax code declaration form.

Scroll down to the bottom of this tab and choose to show the employee's pay rates on their pay slip:

Save this tab setting.

Showing the Employee's Age on their Payslip

To comply with showing the employee's age on their leave and time record, we suggest creating a 'zero value' Custom Pay Type for their date of birth. Let's have a look at such a setup:

Go to the Pay Types Tab of the Employee's Profile to create a new custom pay type:

- Create a Custom Pay with the name field set as the date of birth.

- For easy identification on the payslip and records, we called this: DOB (date of birth) and then the employee's date of birth next to it. e.g. DOB 15-10-2010

- You can choose to put the employee's age (e.g. 14yo) instead of their date of birth, but then you have to update this number each year. Here is an example of this option:

- As this is a 'zero value' transaction, it doesn't matter if you create this as a taxed, or non-taxable pay type. In the example we chose to use the non-taxable pay type.

- Set the rate to zero, so it doesn't impact the pay.

- Set the rate to 'per unit'.

- 'Save' this tab to create this new custom pay type.

Let's take a look at what their Timesheet and Payslip will look like:

Depending on the type of employment agreement, a young employee should see the same information displayed in their timesheet and on their payslips as other employees, except for their age included in the timesheet lines.

- Add a row to the timesheet week and select the date-of-birth pay type you just created.

- Add a 1 (number 1) somewhere in that timesheet row to have that row included in the timesheet. If you leave the row blank, it will be excluded.

- Update and Save the timesheet.

- The Gross is calculated in the same way as for other employees.

- As this minor employee is employed on a casual contract, their Holiday Pay is paid out in each pay and displayed as a separate figure.

- This employee is voluntarily contributing to KiwiSaver, so their employee contribution data is given here.

- Their PAYE tax is deducted in the same way as other employees and paid to the IRD. Their pay day filing is done at the same time as all other employees' filing.

Let's look at the Employee's Payslip

- The employee's date of birth is displayed on the payslip in two places:

- in the timesheet summary, as the timesheet row added, and

- in the pay type summary, showing that this is a zero pay type.

- Their pay rate is displayed under taxable pay types if so selected in the Employee Profile. We recommend this, especially as a minor employee may receive a starting-out pay rate.

- To select this information to show on the payslip, choose 'Yes' in the Standard Pay Tab of the Employee Profile - Payslip setup

.png?width=608&height=427&name=Minor_TimesheetExample%20(1).png)

.png?width=608&height=237&name=Minor_PaySlipExample%20(1).png)