Setting Up Payroll for Parental Leave

Parental leave is an extensive period of unpaid leave, bringing its own challenges to payroll. This article walks you through getting your payroll ready for the parental leave period.

Updated: November 2024

In this article:

- Parental Leave - What I Need To Know

- Preparing Thankyou Payroll for Parental Leave

- Resources and Further Information

- Managing Payroll during Parental Leave

- Payroll for the Returning Employee

- Payroll Exit for the Employee who Does Not Return from Parental Leave

Parental Leave - The Basics

Parental Leave Period

There are 4 main kinds of parental leave, all unpaid by the employer, which your employee may apply for online through their MyIR. The employer no longer needs to verify income for this application.

The period they qualify for is based on their period of employment directly before going on parental leave:

- Employees who have worked for you for six months (for an average of at least 10 hours a week) are entitled to take up to 26 weeks of unpaid parental leave.

- Employees can take up to 12 months of Extended Leave if they have worked at least 10 hours a week for a year or more.

Parental Leave Payments are government-funded payments for up to 26 weeks and are outside of the employer's payroll. Employees who qualify for parental leave payments can choose to first use other types of paid leave they have earned but not used, e.g.

The employee can choose to start their parental leave payment period after they have taken other types of paid leave - even if this is after the child's arrival. Allocated annual leave taken before parental leave will be calculated at the greater of OWP or AWE, as usual.

![]() Granting leave in advance ahead of parental leave is not advisable, as this could be overpaid. When the employee returns to work after parental leave, their work pattern could change affecting allocation. Leave taken is also calculated differently.

Granting leave in advance ahead of parental leave is not advisable, as this could be overpaid. When the employee returns to work after parental leave, their work pattern could change affecting allocation. Leave taken is also calculated differently.

In the Thankyou Payroll System

- Stop paying your employee on parental leave by not toggling them on in a pay run.

- Keep the employee toggled off when they are not being paid. The employee will not receive a payslip and, as you are charged per employee in a pay run, this will keep your costs down. We will not try to do payday filing for this employee's zero pay.

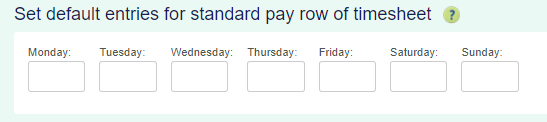

- If you have pay automation, go into the Employee Profile - Standard Pay Tab and remove all entries from the 'Default Standard Week' row. This will ensure that the employee is not included in a pay run. Remember to SAVE this change.

- Take a screenshot of their Leave Liability Table so you have a record of their leave balances before going on parental leave. This leave will continue to be calculated at the greater of OWP and AWE when taken upon the employee's return.

- The system updates calculations and balances when timesheets are processed. Until this is done, their leave liability table will remain unchanged.

Resources and Further Information

If you are unsure of the employee's entitlement, please contact Employment NZ or seek other legal advice.

Below are some links to further information: