Managing Leave Without Pay - LWOP

If an employee is not paid you generally don't create a timesheet for them. This article explores different options for recording leave without pay in the Thankyou Payroll system.

Updated: April 2024

Unpaid leave is granted by employer's discretion and is not a legislative right in New Zealand. Unless otherwise agreed, taking leave without pay doesn't end the employee's employment and they will return to the same position and employment terms afterwards.

|

Do not terminate an employee on LWOP in the payroll system. Please Note: Leave without pay can affect the employee's leave entitlements. Please get advice from Employment New Zealand or an employment lawyer if you are unsure about the impact on your employee's entitlements. |

Thankyou Payroll doesn't have a default LWOP pay type, as LWOP can be recorded outside a payroll system. To keep your costs down (as you are charged per employee in a pay run), it is not advisable to include an employee with zero pay in a pay run as generally you don't create a timesheet if an employee isn't paid.

![]() Funds being transferred activate pay runs. Therefore, if you have a pay run with only Zero-pay employees the pay will not process. Please ALWAYS contact Customer Support to process Zero pays.

Funds being transferred activate pay runs. Therefore, if you have a pay run with only Zero-pay employees the pay will not process. Please ALWAYS contact Customer Support to process Zero pays.

If you want to record LWOP in Thankyou Payroll, here are some options:

In this article:

Leave Without Pay for 1 Work Week or Less

If the employee is being paid for part of their week, you are creating a timesheet for them. You now have the following options for leave without pay:

- You can leave the day entry blank in the employee's timesheet for when they were on LWOP, or

- If you want the employee's payslip to show leave without pay, you can create a Custom Pay Type for this.

- As it is a custom pay type, you can choose to use one pay type for all forms of LWOP, or create different pay types for each form you want to record separately, e.g. LWOP (leave without pay), SLWOP (sick leave without pay) and LWOP Ext (extended leave without pay). The benefit of this is you can customise your reporting if so needed for your specific business.

Creating a Custom Pay Type for LWOP

Let's create a custom pay type for general leave without pay:

- Go to the Pay Types Tab of the Employee's Profile to create a new custom pay type for this transaction.

- Create a Normal Custom Pay Type (taxed) for leave without pay.

- Enter a name for this pay type that is easily recognised on the payslip or for your record keeping.

- In this example, we chose LWOP as this is what the pay type is for.

- Set the rate to 0 (zero), so the actual hours are entered in the timesheet.

- Set the rate to 'per hour' as the hours will be entered in the timesheet.

- 'Save' this tab to create this new custom pay type.

In the timesheet:

- Add 'Standard pay' hours to the timesheet as usual. If you have entered default hours in the employee profile, these will already be prepopulated for you.

- Add a new row to this same timesheet week by clicking on the green + sign above 'update and save'.

- Find and select the pay type you've just created in the dropdown menu for this row.

- In this example, we created the pay type: LWOP.

- Enter the number of hours the employee is on unpaid leave for the days in question. Remove those hours from the 'Standard pay' row to avoid paying these by mistake.

- If your employee is not taking a full day of unpaid leave, enter the hours worked and the hours on leave each in their row:

- Update and Save this timesheet. The timesheet boxes will be green when the timesheet has been saved, as in the example.

- You can left-click in the green timesheet box for an LWOP entry to bring up the costing screen to check it is paid at $0.

Leave Without Pay for More than 1 Week

|

The employee's annual leave is impacted when they take a continuous period of leave without pay for more than a week. *Please contact our Customer Support Team to ensure this attaches properly in the system, especially if the anniversary date is impacted. *If the employee leaves your employment before their anniversary date, their 8% accrual will also need adjusting. Please contact our team to help with this. |

The first week of LWOP does not impact annual leave, but from the second consecutive week onwards (taken together) annual leave is impacted. You and your employee must agree in writing on one of two options:

- Option 1: Their annual leave anniversary date is impacted. The employee's annual leave anniversary moves forward by the number of weeks LWOP taken after the first week.

- e.g. If Alea took 3 weeks of LWOP, her annual leave anniversary date moves forward with 2 weeks (from 1/04/2025 to 15/04/2025). It will remain on the 15th of April going forward.

- Option 2: Their anniversary date stays the same, but when they take annual leave during the next 12 months you will calculate their AWE by the number of weeks they worked.

- e.g. If Alea took 3 weeks of LWOP, her anniversary date stays 1st April. When she takes annual leave during the next 12 months her AWE calculation is divided by 50. This is her number of work weeks (52 - LWOP weeks above the first).

In the Thankyou Payroll System

- Stop paying your employee on LWOP by not toggling them on in a pay run.

- Keep the employee toggled off when they are not being paid. The employee will not receive a pay slip and, as you are charged per employee in a pay run, this will keep your costs down. We will not try to do payday filing for this employee's zero pay.

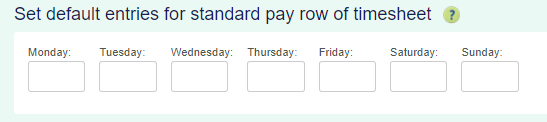

- If you have pay automation, go into the Employee Profile - Standard Pay Tab and remove all entries from the 'Default Standard Week' row. This will ensure that the employee is not included in a pay run. Remember to SAVE this change.

- The system updates calculations and balances when timesheets are processed. Until this is done, your employee's leave liability table will remain unchanged.

Public Holidays and Other Leave Types during LWOP

Generally, if an employee is on leave without pay, this time is not seen as otherwise working days. As leave entitlements are linked to otherwise working days, the employee would not receive paid public holidays off or be able to take other forms of paid leave during this period.

- There are exceptions to this, so please get case-specific advice from Employment New Zealand or an employment lawyer if unsure.

- Follow this link to our example article showing you what this looks like in our system.