How do I Set Up KiwiSaver for Employees under 18 or over 65?

Employer contributions to KiwiSaver are only compulsory for employees who meet the eligibility criteria. This article explains how to set up KiwiSaver in our system for employees outside the eligible age groups.

Updated: February 2024

In this article:

- Useful KiwiSaver information when employing outside the eligibility criteria

- Example of the KiwiSaver setup in the Employee Profile

- Useful links and further resources

What do I need to know about KiwiSaver obligations?

- Employer contributions only become compulsory when the employee turns 18 y/o, and until they turn 65.

- Employer contributions are only compulsory if the employee (18-65 y/o) currently contributes from their pay.

- If the employee (under 18 y/o and over 65) has voluntarily joined KiwiSaver, their employee deductions can be made from their wages.

- They have two options:

- to voluntarily contribute to their KiwiSaver directly, or

- have their employer deduct their contribution directly from their wages.

- They have two options:

- ESCT is the tax deducted from the employer contributions to the employee's KiwiSaver or complying fund. So, this tax is not applicable if you are not contributing to the employee's KiwiSaver.

- If under 18 y/o, the employee has to apply directly with the KiwiSaver Scheme provider. Their parents might need to sign them up. If signed up, they must provide the employer with a KS2 stating the contribution rate.

- As long as the employee is a member of KiwiSaver, the employer can choose to make voluntary employer contributions to the employee's KiwiSaver if the employee falls outside the qualifying criteria (as long as the employee is contributing to the fund from their wages).

- After turning 65, the employee can stop their KiwiSaver deductions from their salary at any time by handing in a Non-deduction Notice KS51.

![]() Take Note: If your employee has joined KiwiSaver after turning 60 y/o, they may be in a five-year lock-in period. This means you must continue your employer contributions until this period expires.

Take Note: If your employee has joined KiwiSaver after turning 60 y/o, they may be in a five-year lock-in period. This means you must continue your employer contributions until this period expires.

KiwiSaver Setup in the Employee Profile

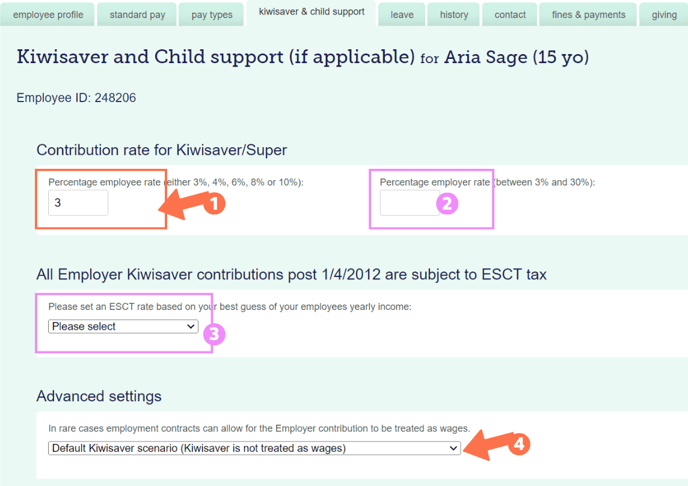

Let's look at setting up the KiwiSaver for employee-only deductions. Note: This is only for employees under the age of 18, and over the age of 65.

Go to the KiwiSaver & Child Support tab in the employee's Employee Profile.

- Enter the employee's contribution rate (minimum 3%) in this field as found on their KS2 form.

- Leave the Employer Contribution Rate field empty for employees under 18y/o and over 65.

- If you want to make voluntary employer contributions, fill in your voluntary rate here.

- Leave the ESCT rate unselected, as you will not be making employer contributions.

- Under Advanced Settings, select the setting as per your employment agreement.

- By default, KiwiSaver is not treated as wages.

- 'Save' the tab to apply the KiwiSaver information.

- You will see a pop-up warning that a zero KiwiSaver employer contribution rate is only applicable in rare situations. As this situation is applicable, click 'OK' to close the pop-up message.