How does Pay Automation Work?

Pay automation is a tool that can run your regular pay without you needing to set up timesheets manually each pay. This article explains how it works.

Updated: November 2025

Setting up pay automation for your pay runs will automate your regular payroll, ensuring that your employees are paid without you needing to create timesheets every pay. For it to work correctly there are some things you have to know.

| Pay Automation is not set and forget. It does require some User intervention when Public Holidays or an out of sequence pay prevent the system creating a regular pay cycle. |

Pay Automation - What I Need To Know

.png?width=300&height=300&name=PayAutomationLoop%20(2).png) Pay automation repeats the same pay, with the same pay cycle, on the same pay day, for the same employees - over and over again.

Pay automation repeats the same pay, with the same pay cycle, on the same pay day, for the same employees - over and over again.

Here is what happens:

- You deposit funds to the Thankyou Payroll Trust Account. When we assign your deposit to your client account - it triggers pay automation to create your pay.

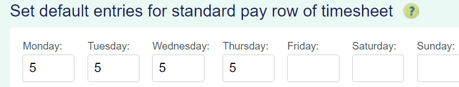

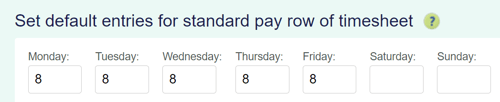

- A default pay will appear on your dashboard for all employees with default entries in the standard pay row of their Employee Profile.

- The employees are paid on your chosen pay day.

- The system waits for your next deposit to repeat the cycle.

What I need for this to work well:

- 'Default entries in the Employee Standard Pay row' for the employees you want to pay with pay automation.

- Pay automation creates a pay using 'standard pay row entries' It does not add public holidays, leave or overtime. These pay types will require manual input of the timesheets.

- Pay automation creates a pay using 'standard pay row entries' It does not add public holidays, leave or overtime. These pay types will require manual input of the timesheets.

- A Regular pay day and pay cycle (weekly/fortnightly/monthly) for these employees.

- The first pay to be manually created setting the first Pay period start date and Pay date

- This first pay will provide the amount you need to set up as your automatic payment in your bank to fund the future pays.

- Leave the first pay on the dashboard to be processed. Your second deposit when received to your client account will trigger the 2nd pay in the automation cycle.

- To setup an Automatic Payment to the Thankyou Payroll Trust Account at your bank.

![]()

Pay automation cannot be funded by Direct Debit, it requires an Automatic Payment to be set up at your bank.

Most common reasons automation fails?

- If your deposit is delayed but received by Thankyou payroll before 6pm the night before your usual pay day:

Your pay will run as an overnight pay.

- If your deposit is delayed, usually by a Public holiday (where the banks are closed), and not able to be allocated to your account by 6pm the night before your pay day:

- Pay Automation will create your pay for your regular pay day in the next week.

- If you pay weekly this pay will be unprocessed on your dashboard when your next deposit arrives. This will block the next pay being created.

- The system will not automatically create a catch up to pay your employees the missing pay.

You will have to create a manual pay

![]() To find out more about pay automation and public holidays, follow this link to our specific help article.

To find out more about pay automation and public holidays, follow this link to our specific help article.

- An open pay on your Dashboard:

- Funds assigned to your client account will only trigger a default pay if there are no open pays on the dashboard.

- Benefit : will not overwrite a timesheet you have created or remove additional pay type entries you have added E.g Leave, Public Holidays, Bonus payments .

- Drawback: will not overwrite a empty manually created timesheet and your employees will not be paid.

| If you create a pay to do a Projection, remember to delete it when you are finished |

- Employees with differing pay cycles:

- Automation only works for one pay day and cycle

- We recommend if you have varying cycles:

- Use Automation for the largest employee group on the same cycle.

- or

- The employees where their pay will have the lest number of adjustments

- Deposit insufficient to fund all employees with default pays in their standard pay:

-

- Pay automation includes all employees with 'default entries saved in their standard pay row'.

- If an employee is temporarily away and not required to be paid remove all default entries from their profile . They can be added back when they return.

- Pay automation includes all employees with 'default entries saved in their standard pay row'.

| If your deposit arrives in our Trust Account without your Client Reference Number, assigning the funds to your account could be delayed until we identify the client they are for. This may disrupt your pay automation cycle. |

Helpful tips to know:

After a pay has been created by Pay Automation:

- You can add or remove employee timesheets to the pay

- You can edit employee timesheets any time up until 6pm the evening before your pay day.

- Remember to deposit any extra funds needed if adding timesheets.

Before a pay has been created by Pay Automation:

- You can still do a manual pay, one-off payment, or correction pay if needed.

- Remember this needs to be process before your regular deposit arrives to prevent it blocking your Pay Automation

Pay automation can be triggered by unexpected deposits to your client account:

- To avoid unwanted staff payments either

- Remove timesheets from any employees you no longer wish to pay going forward

- or

- Deactivate Pay Automation off if you will ne require it going forward

![]() Thankyou Payroll will notify you via email if your pay automation cycle is disrupted by a public holiday, or if you have not fully funded a pay automation pay run.

Thankyou Payroll will notify you via email if your pay automation cycle is disrupted by a public holiday, or if you have not fully funded a pay automation pay run.

Now that you know how pay automation works, you can make your payroll work for you - only minor intervention required.