Checking the Accumulated Holiday Pay Balance for Fixed-Term Employees

Fixed-Term Employees take leave from their accumulated holiday pay balance. It is important to check this balance before paying for a day off.

Updated: June 2023

For a fixed-term employee whose 8% Holiday Pay is accumulated and paid out in their final pay, there will not be a leave calculation cost tracking page generated in the same way as with permanent employees who accrue annual leave.

![]()

The value of the 8% Holiday Pay accumulated to date is displayed in the Leave Liability Table. It is not displayed in the timesheet.

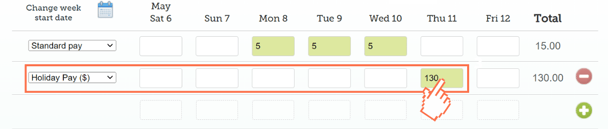

In your saved timesheet (with green boxes), left-click in an entry field to access the cost tracking data for that entry. Here, we will be left-clicking in the $130 Holiday Pay entry.

- This is the Cost Tracking line that is displayed. This amount will be the same as entered in the timesheet as this is already a dollar amount.

An important note:

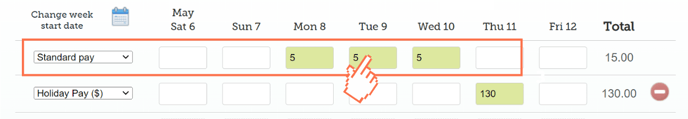

If you click in a 'standard pay' row entry, the cost Tracking line will calculate the value of that day without the 8% Holiday Pay accumulated.

The 8% Holiday Pay accumulated is not included in this amount as it is calculated for the timesheet as a whole and displayed in the leave liability.

- When clicking in the '5' hour worked entry of the standard pay row, this cost tracking line will display. The amount earned for working 5 hours on Tuesday the 9th May is calculated as follows: 5 hours x $26 (hourly rate) = $130

For a quick reminder of how to add holiday pay to your employee's timesheet, follow this link.

Scroll down below the timesheet to the Leave Liability table.

Finding the accumulated Holiday Pay Balance in the Leave Liability Table

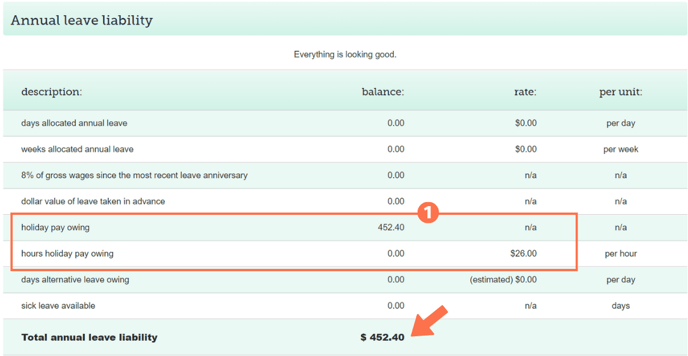

Let's have a look at an example of a fixed-term employee's leave liability table:

- These two lines involving Holiday Pay Owing show the total of accumulated Holiday Pay to be paid when the fixed-term employment comes to an end. This should show a $ balance. The employee's hourly rate is also displayed here.

- The amount entered in the timesheet for Holiday Pay ($) will reduce this Holiday Pay Owing amount by the amount entered.

- This employee has accumulated $582.40 in Holiday Pay before this timesheet. As a result of taking $130 from this amount, the balance here has been reduced to (582.40-130=) $452.40.

- Each time Holiday Pay is included as a payment type in a timesheet, the Holiday Pay Owing balance will be reduced by the corresponding amount.

The Total Leave Liability amount displayed at the bottom of this table is the current estimated value of leave that should be paid out if the employee leaves. This is estimated as the value of alternative leave days owing will be calculated only when taken or paid out.

![]() If the Total Leave Liability amount is NEGATIVE, you have paid for leave your employee has not earned yet and will be out of pocket if they leave today.

If the Total Leave Liability amount is NEGATIVE, you have paid for leave your employee has not earned yet and will be out of pocket if they leave today.

Helpful things to note:

- The Holiday Pay Owing amount will increase with every timesheet as the holiday pay accumulated from hours worked will be added to this balance in the Leave Liability Table.

- If Holiday Pay is paid out in a timesheet, the amount paid will be taken from the Holiday Pay Owing balance.

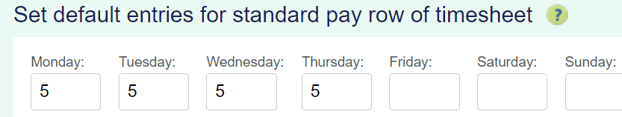

- Check that the day you are entering Holiday Pay as payment for a day off in the timesheet is set up as an otherwise working day in the system.

- This seems simple enough, but so easy to miss. Employees can only take leave on days that are otherwise working days for them. If this is not an otherwise working day, simply delete the entry from the timesheet and SAVE.

- To check up on this, go to the Employee Profile - Standard Pay Tab and see what is entered in the 'default week' settings.

- If the employee's work pattern has changed and this table needs to be updated, be sure to also update the 'Days to complete a week' setting higher up in the same Employee Profile - Standard Pay Tab.

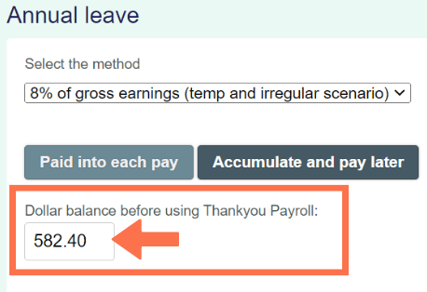

- If you have brought this employee over from another payroll system, check whether their accumulated Holiday Pay balance was brought over correctly.

- Go to the Leave Tab of the

Employee

Employee

Profile and check that you have entered their accumulated Holiday Pay balance from the old payroll system (before starting on the Thankyou Payroll System) in the box as per the example below. This should be a $ amount.

- Go to the Leave Tab of the

![]() Follow this link to an article taking you on the complete annual leave journey - from the correct settings in the Employee Profile, to completing timesheets, reading leave liability, and viewing how this leave is displayed in their payslips.

Follow this link to an article taking you on the complete annual leave journey - from the correct settings in the Employee Profile, to completing timesheets, reading leave liability, and viewing how this leave is displayed in their payslips.