Paying out Lump Sum Payments in a Final Pay

Paying out a lump sum in a final pay is often required for a departing employee. This article shows you how to add this lump sum to the final pay timesheet.

Updated: December 2023

It is quite common for a final pay to include a lump sum payment not included in a regular Pay. These lump sum payments can be based on contractual obligations or the terms of ending the employment.

Whether the lump sum payment is taxed as PAYE, as an extra pay, or excluded from tax is based on the type of payment and the conditions agreed.

Contact Employment New Zealand or MBIE if you have questions regarding the terms of a final pay.

Adding a lump sum payment to a final pay timesheet.

![]() We recommend creating a Custom Pay Type for each agreed lump sum payment to be included in a final pay, instead of pooling them together under the 'Lump Sum' pay type.

We recommend creating a Custom Pay Type for each agreed lump sum payment to be included in a final pay, instead of pooling them together under the 'Lump Sum' pay type.

In that way, each payment and amount is clearly shown on the payslip and easily recognised as paid out.

Creating a Custom Pay Type:

Go to the Pay Types Tab of the Employee's Profile to create a new Custom Pay Type for this employee. For this example, we are using an unworked notice period of 3 weeks paid in lieu, which is agreed to be paid at the ordinary rate and is included in Gross for Annual Leave calculations.

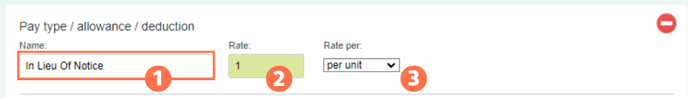

- Create a Taxed Custom Pay Type and enter the name of the payment so it is easily identified on the payslip.

- You can also add a tax-free pay type if the kind of payment requires this, e.g. a personal grievance payment.

- In this example, we called the pay type - In lieu of Notice, as this is what the payment is for.

- Set the rate to 1, so the actual amount paid is entered in the timesheet.

- Set the rate to 'per unit'.

Update this tab to save the new Custom Pay Type just created.

Entering the Custom Pay in the Final Pay Timesheet:

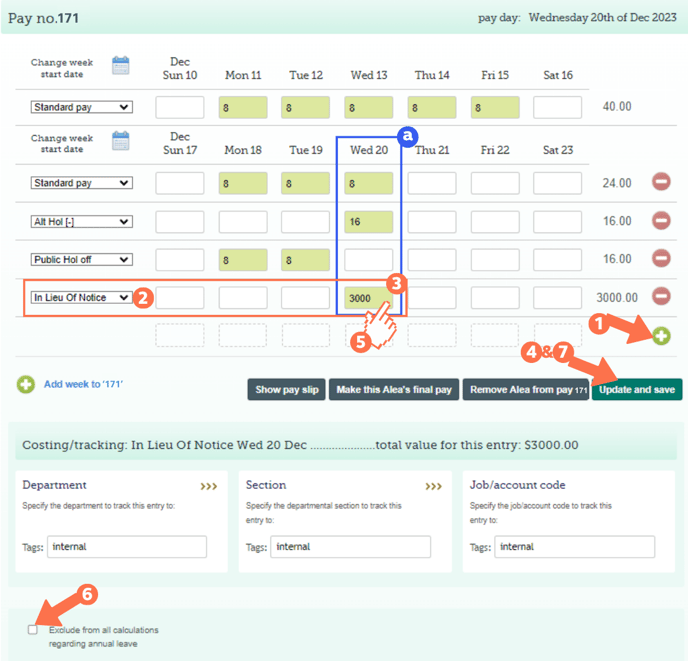

Add a new row to the timesheet by clicking the right 'Add row' + sign. This will add an additional row to the final week of the timesheet.

Select your Custom Pay Type just created from the dropdown menu.

Go to the box directly below the final day (a) in the timesheet and add the amount to be paid out.

Do not input the $ sign.

Use a full stop, not a comma if cents are also included.

Update and save the timesheet.

- Left-click in the input field to access the entry costing screen.

- Select this tick box if the payment is to be excluded from annual leave calculation. In this example, the Notice Paid In Lieu is to be included in annual leave calculations, so this box is left blank.

- Update and Save the timesheet if you need to add additional entries, or 'Make this (employee's) final pay' button to set the Final Pay.

This lump sum payment as well as the amount paid will now be identifiable in the final pay payslip.

That is it! You have added a lump sum payment to your employee's final pay.