Setting Up an Employee without an IRD Number - ND Tax Code

An IRD Number is essential for an Employee Profile to be created. This article shows you how to create an Employee Profile where the IRD number is still pending. This will set the employee's tax code to 'ND'.

Updated: January 2024

If you are waiting on the employee's IRD number, you can set up the employee profile and pay the employee in the meantime until their IRD number becomes available.

![]() Setting up an Employee Profile without an IRD number will set the employee's tax code as 'ND' - non-declaration tax code. This tax is very high and it is strongly recommended to get the employee's IR330 as a priority.

Setting up an Employee Profile without an IRD number will set the employee's tax code as 'ND' - non-declaration tax code. This tax is very high and it is strongly recommended to get the employee's IR330 as a priority.

For more information on Tax Codes, visit the IRD website.

In the Employee Profile Setup

When completing the employee details in the Employee Profile, note the following:

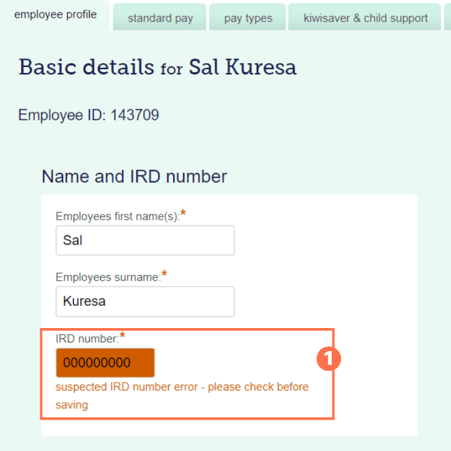

In the Employee Profile Tab:

- For the IRD number field, fill in 9 Zeros as in the example above.

- You will see a warning in red saying that the IRD number has an error. This is expected, as you did not fill in a valid IRD number.

Complete the rest of the Employee Profile page and 'Save'.

|

You will see a pop-up message informing you that the nil IRD number will set the employee's tax code to ND. This is expected, as you cannot have a declared tax code without an IRD number. Simply click the blue 'OK' button on the pop-up message to continue setting up the employee profile. |

Note: Every time you press 'Save' or 'Save and Next' while setting up this employee profile, you will get this same pop-up message.

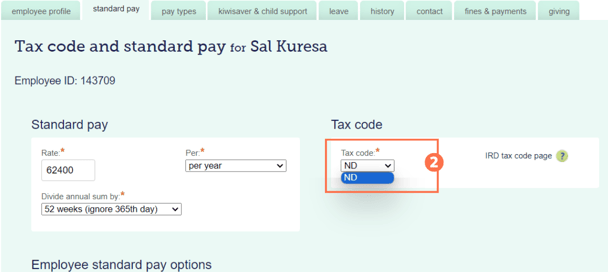

In the Standard Pay Tab:

Next to the employee's standard pay, you will find the tax code dropdown menu that usually has all the tax codes preloaded.

2. The only tax code available for this employee is ND, which will already be selected by default.

Complete the rest of the page details and click 'Save' to update this setting.

Now, complete the rest of the employee setup as for any other employee. Remember to 'Save' each tab after completing it.

What will I see on the Timesheet?

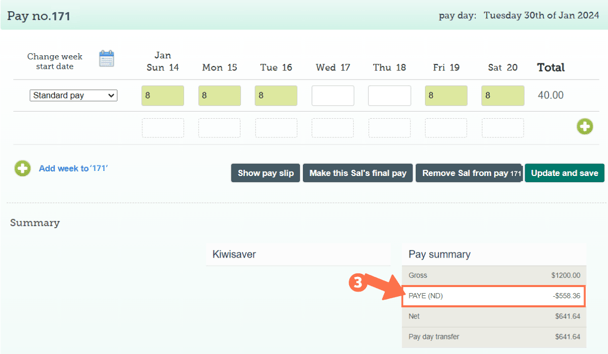

![]() Tax for the ND tax code is calculated at 46.5%, which is the ND tax rate of 45% and ACC levies.

Tax for the ND tax code is calculated at 46.5%, which is the ND tax rate of 45% and ACC levies.

When creating a timesheet, simply select the 'Standard Pay' pay type as usual from the pay type menu.

3. The ND tax code will be applied automatically to the timesheet.

What if I Receive the Employee's IRD Number?

Update the employee's profile in TWO places:

- In the 'Employee Profile Tab', replace the 9 zeros with the employee's IRD number and 'Save'.

- In the 'Standard Pay Tab', select the employee's tax code from the dropdown menu and 'Save'.

- Follow this link for a helpful article on how to update tax codes correctly.

![]() Entering the IRD number will not update the employee's tax code automatically. You have to select the correct tax code from the dropdown menu.

Entering the IRD number will not update the employee's tax code automatically. You have to select the correct tax code from the dropdown menu.

That is it! Please reach out to our Customer Support Team

if you are unsure about employee settings. We're here to help.