Employee Setup if you have an Annual Closedown

If you have a regular annual closedown period within 12 months of a new employees start date and they will be required to stop working and take their annual leave, you need to set them up differently to usual. Follow this article to get this right.

Updated: October 2025

If you are hiring a new employee, chances are that your closedown will occur before they reach their 12-month annual leave entitlement date.

![]() If the annual closedown falls before the employee's 12-month annual leave allocation date, you MUST do the following:

If the annual closedown falls before the employee's 12-month annual leave allocation date, you MUST do the following:

- pay out their 8% of gross earnings since the start of employment, and

- move their annual leave anniversary date to the start of the closedown, or to a date of your choice near the closedown period.

Initial Employee Setup

When you first set this new employee up in the system, you will have to use the leave setting: ' 8% of gross earnings (temp and irregular scenario)' - Accumulate and pay later. This is so that the 8% of gross earnings you MUST pay out at the annual closedown will be calculated correctly.

- In the 'Leave' tab of the Employee Profile, set the leave setting to '8% of gross earnings (temp and irregular scenario)'.

- Select the 'accumulate and pay later' setting so you can pay out the balance at the start of your annual closedown.

- The Sick Leave allocation date will be their start date.

![]() If your employee requests leave in advance during this first year while they are on the '8% of gross' leave setting, pay this out as holiday pay. Here is an article showing you how to do this.

If your employee requests leave in advance during this first year while they are on the '8% of gross' leave setting, pay this out as holiday pay. Here is an article showing you how to do this.

At the time of the Closedown

Step 1: Pay out 8% of Gross Earnings

Pay out their total amount of Holiday Pay showing at the bottom of their Leave Liability box, Holiday pay already paid has already been deducted. Here is an article to show you how to do this.

Step 2: Updating Employee Settings

This can be done once the Holiday pay has been loaded in the timesheet for the closedown period or before you load the first pay after your annual closedown.

There are three changes to make so that your employee will accrue leave correctly:

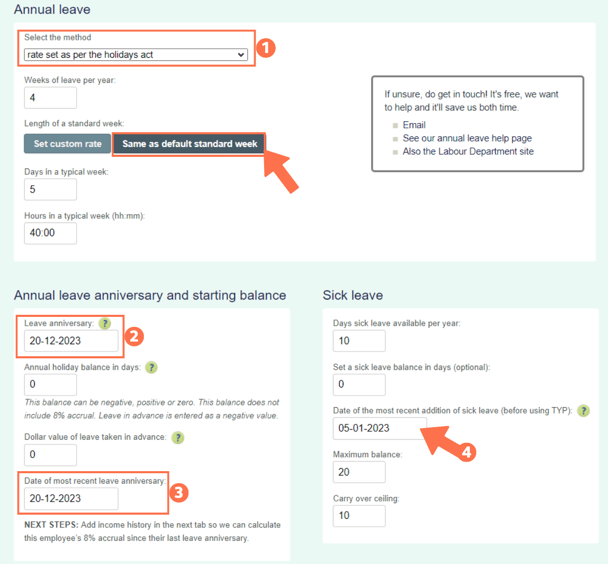

- In the 'Leave' tab of the Employee Profile, change the leave setting to 'rate set as per the Holidays Act'. Check that the weeks of leave, days in a week and hours are correct.

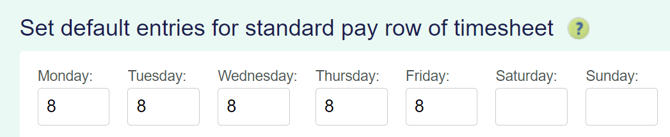

- We recommend the 'same as default standard week' setting if you have completed the 'set default entries for standard pay row of timesheet' in the Standard Pay tab.

- Change their leave anniversary date to the start date of the annual closedown, or another nearby date.

- Change their 'date of most recent leave anniversary' to the start date of the closedown, or your chosen date.

- The sick leave anniversary date will remain as their original start date and do not change this.

Have the wrong setting?

Please contact our Customer Support Team for assistance.

![]() If you are at all unsure about updating the employee's settings or if you have any questions, contact our Customer Support Team. We are here to help and will check that everything has been updated as needed in the system.

If you are at all unsure about updating the employee's settings or if you have any questions, contact our Customer Support Team. We are here to help and will check that everything has been updated as needed in the system.

That is it! You have successfully updated your permanent employee's annual leave settings as affected by the annual closedown.

![]() Follow this link for more information on annual closedowns from Employment New Zealand.

Follow this link for more information on annual closedowns from Employment New Zealand.

*Follow this link to access an Annual closedown flowchart.

.png?width=608&height=286&name=Dashboard_Closedown_FirstSetup%20(1).png)