Correction Pays - Making a Correction if the Employee's Work Pattern has Changed

Correction pays are done to update pay types or hours on an already-processed pay. This article walks you through updating your employee's pay history if their work pattern has changed since the time of the original pay to be corrected.

Updated: February 2024

Correction pays are unavoidable in any payroll. To learn the basics on how to do them in our system, follow this link to our correction pay article.

This article will show how to avoid some of the more common pitfalls around doing correction pays:

- Change in employee work pattern since original timesheet

- Correcting wrong pay rates in original pay, e.g. AWE vs OWP

![]() Correction pays use the current pay values, so will not take into account past pay rates.

Correction pays use the current pay values, so will not take into account past pay rates.

*If you are correcting annual leave from a long time ago, average rates may have been applicable instead of ordinary rates which is what your employee was paid. Please get some advice from Employment New Zealand as this will not comply with the Holidays Act.

Doing a Correction Pay if Work Patterns Have Changed

Whenever you do a correction pay, it is recommended to check the Costing Screen for that entry to check that what you intended, is actually done in the system. Remember that the system uses current values and work patterns entered to calculate timesheets.

Let's see how to check the Costing Screen on a correction pay:

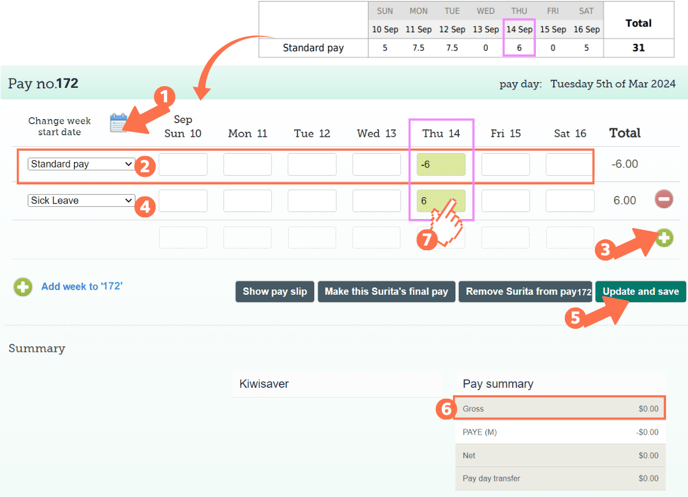

In this example, the employee should have received Sick Leave instead of their standard pay for Thursday 14 September 2023. You do the correction in March 2024, after the employee's work pattern has changed.

- Create a one-off pay on the dashboard outside your regular pay cycle with the period start date the same as the week of the payslip in question. Toggle on the employee in question and go to their timesheet.

- If you did not set the Dashboard pay up with the payslip start date, you can click the calendar icon and pick the week's start date from there. The dates of the entries in this correction pay must be the same as the dates in the original pay.

- For the first timesheet row, select the payment type to be corrected. In this example, it is: 'Standard Pay'. Fill in the negative value of the hours for each entry to be updated in that row. This will add back the original hours to the 'standard pay' pay type to avoid double paying for the same day.

- In this example, for the 6 hours on Thursday 14th Sept, enter -6 in the correction timesheet.

- Add a new row to the timesheet by clicking the green +sign on the right.

- This will add a second row to the timesheet for the same week.

Select the pay type the entry should have had and fill in the hours that should have been in the original entry in that row.

- These hours are positive values.

- In this example, select 'Sick Leave' from the dropdown menu and enter 6 in the timesheet field.

Update and Save this timesheet. The timesheet boxes will be green when the timesheet has been saved, as in the example.

If you get a pop-up message telling you that 'Gross wages are currently less than 0...', please contact our support team.

OK the pop-up message and check your calculations again.

The 'Gross balance' for the correction pay should be $0. But you are not done yet. The most important part of the correction pay comes next!

- Left-click in the entry field/s of the timesheet to bring up the Costing Screen for each entry. Here you can check that the correct number of days are added/removed from leave balances as intended.

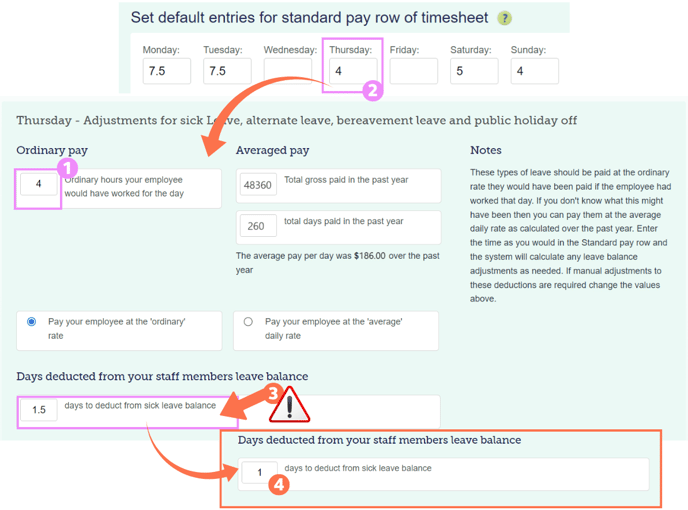

Let's look at the Costing Screen for this Sick Leave correction pay:

After you have emailed the Customer Success Team, your correction pay will be done and the right number of days will be deducted from your employee's leave balances.

- Note that the number of ordinary hours the system recognises for a Thursday is 4. Where does this number come from?

- The employee's current work pattern is set in their Employee Profile - Standard Pay tab.

- You will see in the example 'default entries' that 4 hours is set in the system for a Thursday. This represents the current work pattern.

- Based on the current work pattern, you will see that 1.5 days are deducted from the employee's sick leave balance for this correction pay. (If 4 hours = 1 day, then 6 hours =1.5 days)

- If this leave was taken today, this would be correct, but as this is a correction for a previous work pattern, ask yourself: How many days should be taken here?

- Originally the 6 hours was 1 day, so the employee should only be deducted 1 day from their sick leave balance

- Left-click in the 'number of days deducted' entry box and update this to the correct amount.

- in this example, I've changed this number to 1

- Now Update and Save the timesheet again to save this change.

![]() A zero-pay will not run by itself. Please write an email to our Customer Support Team at help@thankyoupayroll.co.nz to process this request. Include the pay number and a brief description of the reasons for the correction pay in the email.

A zero-pay will not run by itself. Please write an email to our Customer Support Team at help@thankyoupayroll.co.nz to process this request. Include the pay number and a brief description of the reasons for the correction pay in the email.

Correcting Incorrect Pay Rate Calculations Used in the Original Pay.

![]() Take care when correcting historic annual leave where average pay rates were applied instead of ordinary rates - which is what your employee should have been paid.

Take care when correcting historic annual leave where average pay rates were applied instead of ordinary rates - which is what your employee should have been paid.

*Please get some advice from Employment New Zealand as this will not comply with the Holidays Act.

In a correction pay, current values are applicable so if you are correcting a pay using average rates after a change i.e pay rise, work pattern increase etc, the average rate will be different from the original pay. Chances are that this average rate will be less than the current ordinary rate. We cannot change the current pay rate to a rate that is less than the Ordinary Pay rate. You may need to create a custom pay type for this correction pay after getting advice from Employment New Zealand.

![]() Please always reach out to our Customer Support Team at help@thankyoupayroll.co.nz or give them a call on 04 488 7531 if your correction pay doesn't zero out. We are here to help you.

Please always reach out to our Customer Support Team at help@thankyoupayroll.co.nz or give them a call on 04 488 7531 if your correction pay doesn't zero out. We are here to help you.