Changing Tax Codes - Updating an Active Employee Profile

IRD could notify you to change an employee's tax code. This article walks you through changing the tax code for an active Employee Profile.

Updated: January 2024

There are many reasons an employee might need to change their tax code. They could have repaid their student loan, this might have become their secondary income, or they could be on Parental Leave receiving payments for example - reasons abound. Whatever the reason, it is important to know how to update an Employee's tax code when so directed by the IRD.

![]() File any Tax Code change orders as part of your payroll record keeping, so you can access this when required.

File any Tax Code change orders as part of your payroll record keeping, so you can access this when required.

For more information on Tax Codes, visit the IRD website.

Updating a Tax Code

|

A timesheet can only have ONE tax code and will always use the latest information. If you need to update the tax code in the middle of a pay period (e.g. a monthly pay), we recommend splitting the pay.

|

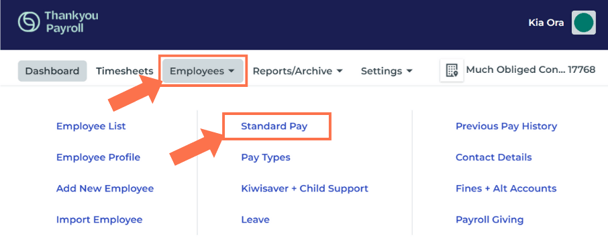

Where to Change the Tax Code:

From the Dashboard, go to 'Employees' and select 'Standard Pay' from the dropdown menu. This will take you to the employee's Standard Pay tab, from where you can update their tax code.

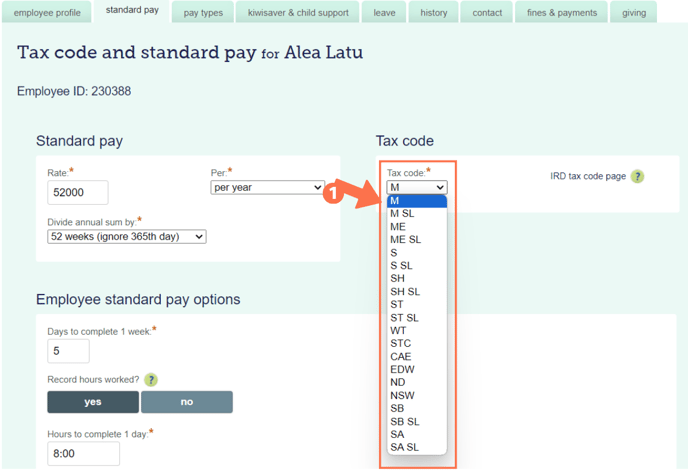

Changing the Tax Code:

Next to the employee's standard pay, you will find the tax code dropdown menu with all the tax codes preloaded.

- Select the new tax code from the dropdown menu.

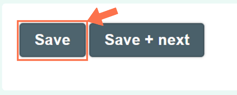

- Scroll down to the bottom of the page and click 'Save' to update this setting.

This employee's tax code has now been updated and when you open any pay on the dashboard, the tax code will update to this setting.

![]() If you have a notice from the IRD to deduct a student loan at a special rate, you have to select the tax code 'STC' and then select the option that applies. Here is an article on how to do this.

If you have a notice from the IRD to deduct a student loan at a special rate, you have to select the tax code 'STC' and then select the option that applies. Here is an article on how to do this.

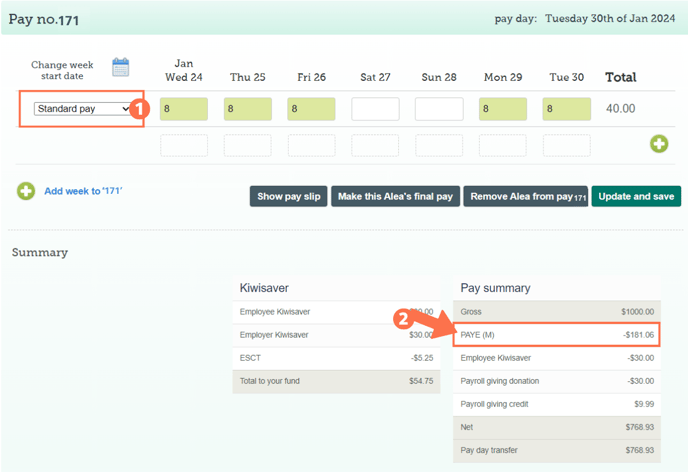

What will I see on the Timesheet?

When you update employee settings, an open timesheet on the dashboard will display the pay type 'Standard Pay (-1)' to show entries that were added before the updated setting. This pay type will not display in new timesheets created after updating employee settings.

- When creating a timesheet, simply select the 'Standard Pay' pay type as usual from the pay type menu.

- The new tax code will automatically be applied.

That is it! Now you know how to update an employee's tax code, easy as pie!