Cashing up Alternative Leave Balance for Permanent Employees

Alternative Leave can be cashed up after 12 months if it is not used. This article will show you how.

Updated: August 2023

![]() When alternative leave is earned, taken, and paid out form part of your employee's Leave and Time Record that must be kept for a minimum of 7 years. This includes the calculation used and agreement made for paying out this form of leave.

When alternative leave is earned, taken, and paid out form part of your employee's Leave and Time Record that must be kept for a minimum of 7 years. This includes the calculation used and agreement made for paying out this form of leave.

Unless this is a final pay (termination pay) which has definite rules to follow, alternative leave may be cashed up if the employee doesn't take it within 12 months from becoming entitled to it. This is done by agreement between the employer and employee:

- The payment amount must be agreed on, as the Act doesn't spesify a calculation to be used for this extra pay. We recommend using relevant daily pay (or average daily pay), same as when the leave is taken.

- If another calculation is used by agreement, set up a unique paytype for this.

This article will explain how to cash up alternative leave based on RDP (or ADP).

How to cash up Alternative Leave in a Permanent Employee's Timesheet using RDP (or ADP).

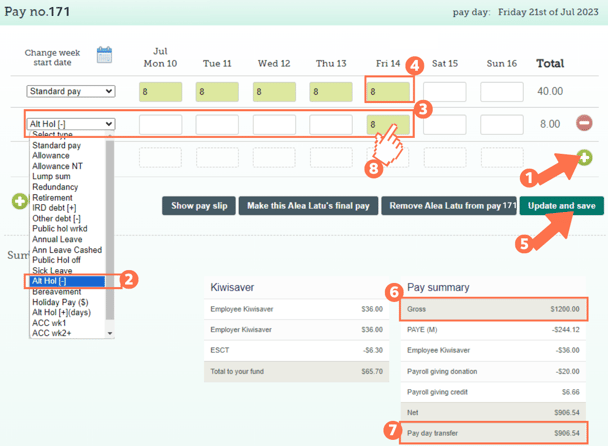

![]() Alternative Leave is entered on a timesheet the same way you enter the employee's standard pay.

Alternative Leave is entered on a timesheet the same way you enter the employee's standard pay.

*The alternative leave balance is calculated in days.

Add a new row to the timesheet by clicking on the green + sign.

Select the payment type: 'Alt Hol (-)' from the dropdown menu on the left of this row.

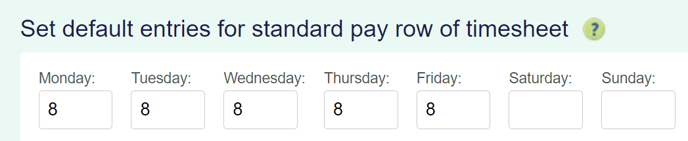

For the alternative leave, fill in the number of hours normally worked (or as agreed to be used for this payment) for any day in this row. To check standard hours, look at the 'default entries for standard pay row' settings in the Employee Profile.

Leave the 'Standard Pay' row entry there for the corresponding day. As this is an extra pay, the employee should still be paid their regular salary/wages for working on this day.

Update and Save this timesheet. The timesheet boxes will be green when the timesheet has been saved, as in the example.

Check the 'Gross balance' for the pay period to ensure that this is correct. The gross balance should include this extra pay.

The 'Pay day transfer' amount is what the employee will receive in their bank account.

To check that the alternative leave is being paid at the expected rate and htat only 1 day is deducted from their alternative leave balance, left-click in the green timesheet box for this entry. Follow this link for a walkthrough on how to check this cost calculation.

Cashing up more than 1 day of alternative leave:

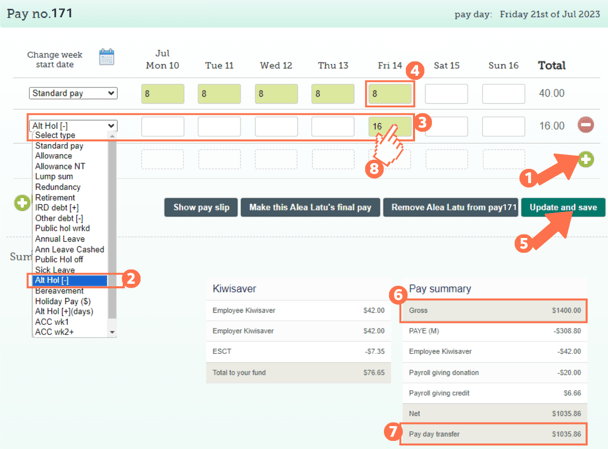

Add a new row to the timesheet by clicking on the green + sign.

Select the payment type: 'Alt Hol (-)' from the dropdown menu on the left of this row.

For the alternative leave, fill in the number of hours to be cashed out (or as agreed to be used for this payment) for any day in this row.

- For this example, the employee is cashing up 2 days of alternative leave, so their 8-hour workday hours are x 2, bringing the number entered in the box to 16.

Leave the 'Standard Pay' row entry there for the corresponding day. As this is an extra pay, the employee should still be paid their regular salary/wages for working on this day.

Update and Save this timesheet. The timesheet boxes will be green when the timesheet has been saved, as in the example.

Check the 'Gross balance' for the pay period to ensure that this is correct. The gross balance should include this extra pay.

- In this example it is clear that the gross balance includes the $400.00 pay, as the ordinary weekly pay is $1000.00.

The 'Pay day transfer' amount is what the employee will receive in their bank account.

To check that the alternative leave is being paid at the expected rate and that the correct number of days are deducted from their alternative leave balance, left-click in the green timesheet box for this entry. Follow this link for a walkthrough on how to check this cost calculation.

That is it! You have now successfully cashed up your employee's alternative leave.

![]() For more information on alternative leave, check the Employment New Zealand website.

For more information on alternative leave, check the Employment New Zealand website.