How do I calculate accrued leave for extra weeks above the 4-week annual leave entitlement?

When providing 5 or more weeks of annual leave, it is beneficial to calculate the value of this accrual to inform leave in advance for example. This article will show you how.

Updated: September 2023

To calculate the value of accrual, you will use the numbers provided in the employee's Leave Liability Table.

Please note that if you have an active timesheet on the dashboard, leave liability calculations will be affected in the following ways:

- If your timesheet has green boxes, the numbers in the leave liability table will include this timesheet.

- If your timesheet has grey boxes, the leave liability table shows figures as before this timesheet.

- where leave liability has a negative allocated leave balance, indicating that leave in advance has already been granted previously, and

- where the leave liability has positive leave balances.

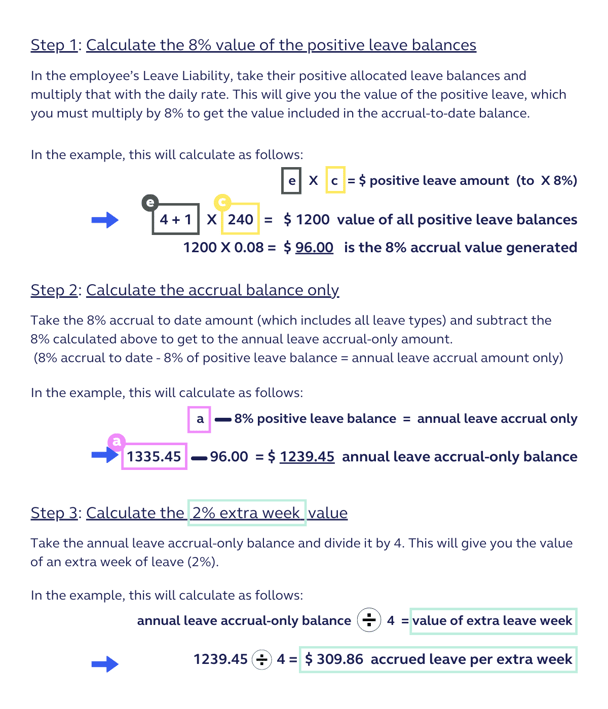

Leave Liability with a Negative Allocated Leave Balance

![]() The dollar value of leave in advance needs to be deducted from the total leave accrual to date to get an accurate day count of the accrual balance available.

The dollar value of leave in advance needs to be deducted from the total leave accrual to date to get an accurate day count of the accrual balance available.

This is an example Leave Liability Table we will use for this section:

* If you provide 6 weeks of Annual Leave, simply double the 2% value in Step 2.

e.g. a + (2% value x 2) - b = true accrual

➡️1335.45 + (333.86 x 2) - 401.68 = $1601.49 as the current accrual balance for 6 weeks of annual leave.

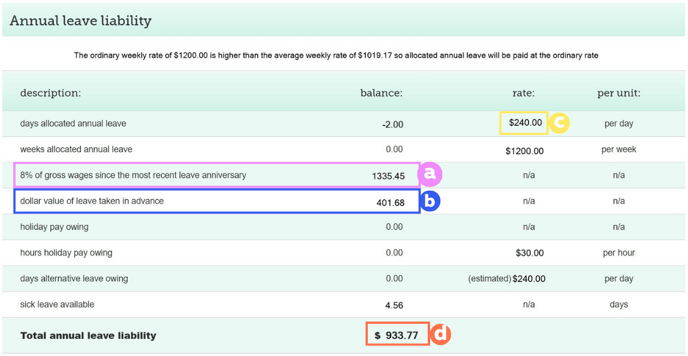

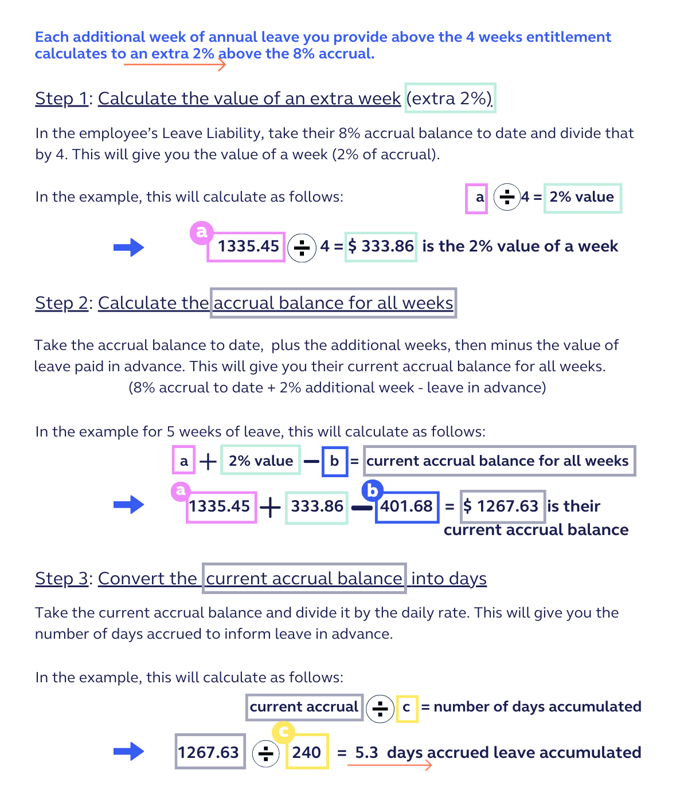

Leave Liability with a Positive Allocated Leave Balance and/or Alternative Leave Owing

Positive leave balances, except sick leave, also accrue at 8% and this accrual is included in the 8% of gross wages amount. If your employee has these positive balances from allocated but untaken leave types, you will have to first deduct their 8% accrual from the accrual-to-date amount in order to get the annual leave-only accrual value. You will then use this annual leave-only accrual to calculate the value of additional weeks of annual leave.

![]() The 8% gross-to-date amount includes 8% accrual from all allocated but untaken leave types (except sick leave).

The 8% gross-to-date amount includes 8% accrual from all allocated but untaken leave types (except sick leave).

Let's work through an example to calculate the value of a 5th weeks accrual:

We will use this leave liability table with positive leave balances to do the 5th-week calculations:

Now that you have the accrual value of an additional week, you can calculate the number of annual leave days accrued to date as follows:

* annual leave accrual-only amount + 5th week accrual amount

= current annual leave accrual balance

➡️ $1239.45 + $309.86 = $1549.31

*divide the current annual leave accrual balance by the daily rate (c)

➡️ $1549.31 / 240 = 6.5 days accrued leave accumulated

.png?width=608&height=313&name=LeaveLiability_5thWeek_PositiveALCalculation%20(1).png)