Cashing up Annual Leave

Employees can ask to cash up a total of one week of their four weeks' minimum entitlement to annual leave (based on their work week) each year in stead of taking the paid time off work.

Updated: July 2023

Employees can request in writing that a part of their annual leave entitlement be paid out in cash each year. This is granted by agreement and the employer doesn't have to agree to cash up annual leave.

- Up to 1 week of the 4 weeks annual leave entitlement may be cashed up annually.

- This week is based on their otherwise working day work pattern, so an employee who only works 3 days per week can cash up a total of 3 days of allocated annual leave per year. If an employee's work week is 5 days per week, they can cash up 5 days in total of their available allocation yearly.

- Cashing up annual leave is only for the current year of employment. An employee may not cash up previous years lumped together, e.g. they've worked for you for five years and now request that 5 weeks be cashed up. This is not compliant. They can only cash up a maximum of one week in a year.

- Employees may request to cash up less than a week. They do not have to cash up a full week of annual leave in a year.

- Cashing up may be done throughout the year at different times, as long as the total amount does not exceed 1 work week of annual leave per year.

- If more than 4 weeks of annual leave is given, the extra weeks may also be cashed up if the employer agrees, e.g. if 5 weeks of annual leave is given, 2 work weeks may be cashed up if agreed.

Adding Annual Leave Cashed to a Timesheet

![]() Annual leave cashed has to be added to an active timesheet with a 'Standard Pay' row with values for the timesheet to process.

Annual leave cashed has to be added to an active timesheet with a 'Standard Pay' row with values for the timesheet to process.

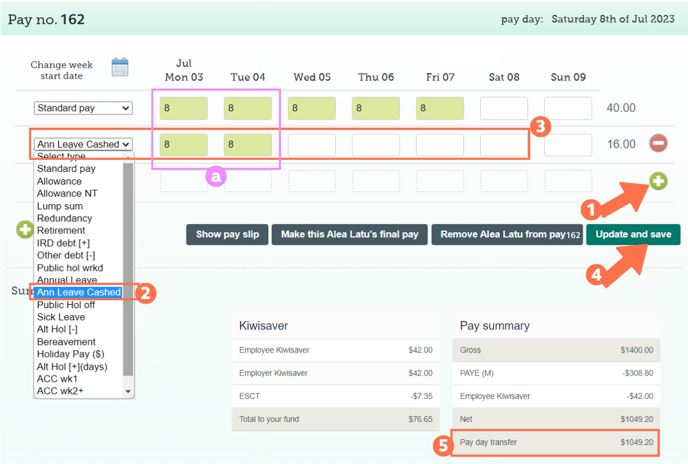

Let's look at an example of adding 2 days of Annual Leave Cashed to a timesheet:

In an active timesheet, with the 'Standard Pay' row filled out, add another row by clicking on the green + sign.

Select the payment type: 'Ann Leave Cashed' from the dropdown menu on the left of this row.

Fill in the regular hours of leave to be cashed up in any of the blocks in this row. This will be the regular hours the employee works, as found in their 'default entries for standard pay row' in their Employee Profile.

There will be time entries for both the 'Standard Pay' row and the 'Ann Leave Cashed' row for cashed-up leave.

Update and Save the timesheet. The timesheet boxes will be green when the timesheet has been saved, as in this example.

Note that the pay day transfer will include their regular pay, plus the cashed-up annual leave effectively paying them twice on days cashed-up leave was added in the timesheet.

Helpful things to Note:

- You can check the Annual Leave Cashed calculations in the same way you check annual leave taken by clicking in the green entry field after the timesheet has been saved. For an example of how to do this, follow this link.

- The system will calculate the tax at a higher rate for this pay. This is normal and the employee will likely be refunded in their end-of-year tax return.

- For more information on cashing up annual leave, please refer to the Employment New Zealand website.

That is it! You have now successfully cashed up annual leave as requested by your employee.