Adding Sick Leave to a Timesheet for a Qualifying Casual Employee

When adding sick leave to your casual employee's timesheet, there are some important things to note. This article will take you through these.

Updated: July 2023

![]() Not all casual employees qualify to receive sick leave entitlements. If they have yet to qualify for the current entitlement, do the hours test to ensure this casual has met the minimum criteria.

Not all casual employees qualify to receive sick leave entitlements. If they have yet to qualify for the current entitlement, do the hours test to ensure this casual has met the minimum criteria.

Important information to note before you start:

- Have worked AN AVERAGE of at least 10 hours per week over the last 6 months for this employer, and one of the following:

- No less than 1 hour every week during that time, or

- No less than 40 hours in every month of those 6 months.

- Note that the sick leave entitlement is 10 days and is not pro-rated based on the number of working days a week.

- Each entitlement is based on a roaming assessment. This works as follows: on the sick leave anniversary date the Hours Test should be performed again to assess eligibility for a further 10 days sick leave entitlement. If not met then, the test should be done at each request for sick leave until such a time as the criteria are met and the entitlement received.

![]() The Thankyou Payroll system automatically assigns 10 days of sick leave after 6 months of employment. It is the employer's responsibility to check their employee's eligibility and perform the Hours Test before adding this to a timesheet.

The Thankyou Payroll system automatically assigns 10 days of sick leave after 6 months of employment. It is the employer's responsibility to check their employee's eligibility and perform the Hours Test before adding this to a timesheet.

The Thankyou Payroll system and sick leave under the '8% of Gross Earnings (temp and irregular scenario)' leave setting:

-

As the casual employee doesn't have 'otherwise working days', they can take sick leave on any day they are offered work.

-

They do not have a specified day size or set number of hours per day in the system, so the system will deduct a full day of sick leave for every sick leave entry regardless of the number of hours in the box.

-

If part days are taken as sick leave, you will have to manually adjust this in the Costing Screen.

-

This is the same for all employees with the '8% of Gross earnings (temp and irregular scenario)' setting.

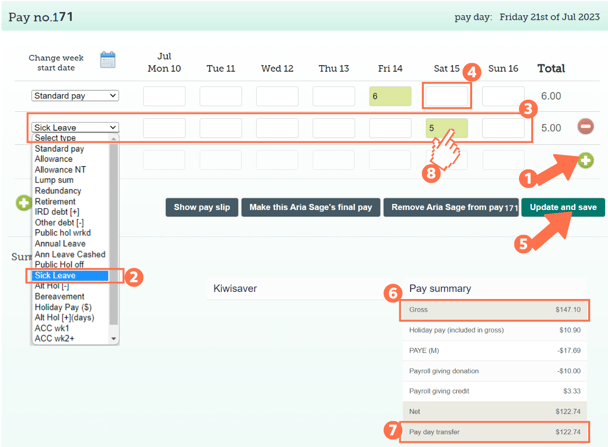

Adding Sick Leave to a Casual Employee's Timesheet

![]() Sick leave is added in hours into a timesheet, but deducted in days (or part days) from the sick leave balance.

Sick leave is added in hours into a timesheet, but deducted in days (or part days) from the sick leave balance.

Let's look at a timesheet for a casual employee who has qualified for the 10 days sick leave entitlement:

- Add a new row to the timesheet by clicking on the green + sign.

- Select the payment type: 'Sick Leave' from the dropdown menu on the left of this row.

- For the sick leave entry, fill in the number of hours the employee is taking leave for the day in question. The system will deduct a full day of leave, and pay for a full day of leave regardless of the number put into this box.

- Casual employees do not have set hours in the system. Because of their leave setting (8% of gross), the system will take any number here as a full day.

- Adjust the 'Standard Pay' row entry for the corresponding day. Ensure that you remove any entries for this day's box if they are taking a full day of sick leave. This will ensure that the employee is not paid twice for the same day.

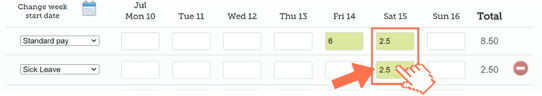

- If your employee is not taking a full day of sick leave, enter the hours worked and the hours on sick leave into the corresponding fields. You have to also manually change the number of days deducted from their sick leave balance to match. You do this in the Costing Screen after you have updated and saved the timesheet. In this example, the employee is only taking half the day as sick leave:

- Update and Save this timesheet. The timesheet boxes will be green when the timesheet has been saved, as in the example.

- Check the 'Gross balance' for the pay period to ensure that this is correct.

- The 'Pay day transfer' amount is what the employee will receive in their bank account.

- To check that the sick leave balance is deducted correctly or to adjust the number of days deducted if taking a part of a day off, left-click in the green timesheet box for that entry. This will bring up the cost calculation screen, which also shows the pay calculation details. Follow the link to an article on how to interpret this screen.

That is it! You have now successfully loaded sick leave to your casual employee's timesheet.

![]() If you want to find out more about sick leave, check the Employment New Zealand website. They also have useful information to understand casual employment, as this is not a term defined in employment legislation.

If you want to find out more about sick leave, check the Employment New Zealand website. They also have useful information to understand casual employment, as this is not a term defined in employment legislation.