ACC - Paying Your Employee After an Accident

This article walks you through managing ACC in our system. Read on to find useful information for when your employee is on extended ACC.

Updated: February 2024

| Communication with ACC is key while your employee is receiving ACC weekly compensation payments. ACC should be advised of any additional income including payment for a public holiday or for some hours worked (abatement), as this may affect the calculation of the employee's weekly compensation. |

In this article:

- Payroll during ACC Week 1

- Voluntary Top-Ups

- Payroll during ACC Week 2 Onwards Till Employee's Return

- Resources and Further Information

![]() The period an employee is off work receiving ACC compensation is considered continuous employment. Do not terminate the employee in the payroll system.

The period an employee is off work receiving ACC compensation is considered continuous employment. Do not terminate the employee in the payroll system.

*If your employee is off work on ACC for more than 6 weeks, we recommend that you contact ACC as to the status of their annual leave. Their accrual will still only be 8% of their Gross earnings (of what you have paid them), but their leave anniversary (thus allocation) could fall within this extended period.

Payroll during ACC Week 1

![]() Use the system pay type: 'ACC wk1' for the first week of employer-paid ACC. This pay type is programmed to pay out 80% of the employee's standard pay, so you don't have to make that calculation yourself.

Use the system pay type: 'ACC wk1' for the first week of employer-paid ACC. This pay type is programmed to pay out 80% of the employee's standard pay, so you don't have to make that calculation yourself.

*ACC is added in the same way you add standard pay to the timesheet.

ACC sends out a notice if an injury is covered by them and will include the percentage of wages or salary to be paid by the employer. Usually, the first calendar week of ACC is employer-paid for workplace injuries and comes to 80% of the employee's standard pay.

*The information in this article is for Standard Scheme: Workplace Cover agreements with ACC. If your organisation uses AEP - Accredited Employers Programme, follow the guidelines as per your agreement with ACC.

*Topping up the employee's salary to 100% is by choice and agreement. Follow this information if you want to top up the employee's pay within the first week of ACC.

If the employee was injured outside of work, they could use their sick leave, annual leave or Family Violence Leave (if applicable) for the first week of recovery.

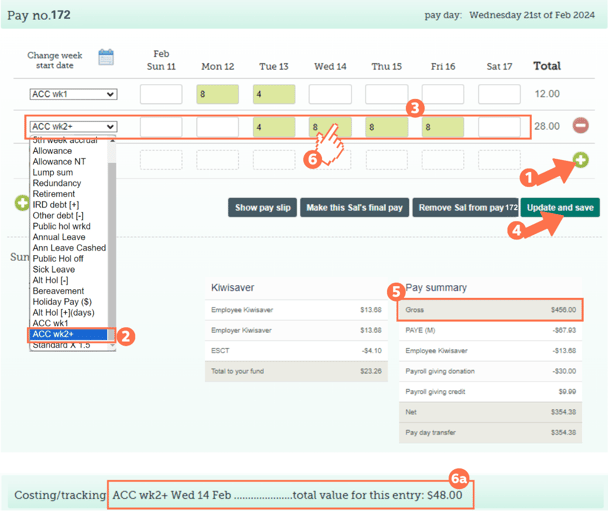

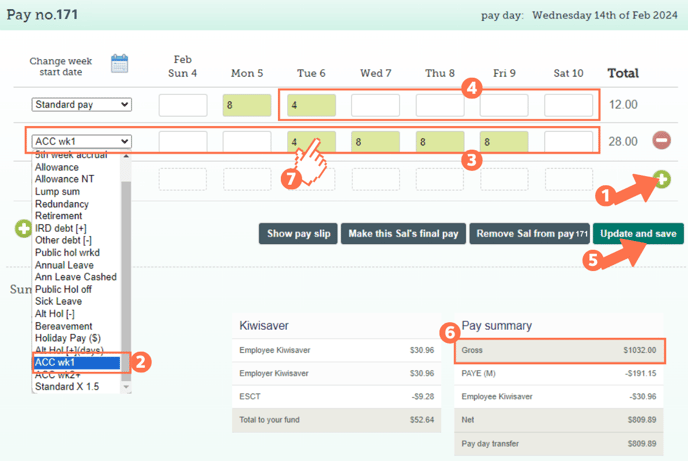

Let's look at adding 'ACC wk1' to a timesheet:

- Add a new row to the timesheet by clicking the green +sign on the right.

- If your employee is taking the whole week as ACC, you can simply change the 'Standard pay' pay type to 'ACC wk1' by selecting this from the dropdown menu of the first row.

- Select the payment type: 'ACC wk1' from the dropdown menu on the left of this row.

- Fill in the hours for each ACC entry in that row.

- These hours must correspond to the employee's regular hours as set as the 'Default entries' of their Employee Profile.

- Adjust the 'Standard Pay' row entry for the corresponding days.

- Delete the standard hours from this row so the employee is not paid twice for the same day.

- Update and Save this timesheet. The timesheet boxes will be green when the timesheet has been saved, as in the example.

- Check the 'Gross balance' for the pay period to ensure that this is correct.

- You can left-click in the timesheet entry field of any timesheet entry to view its Costing Screen.

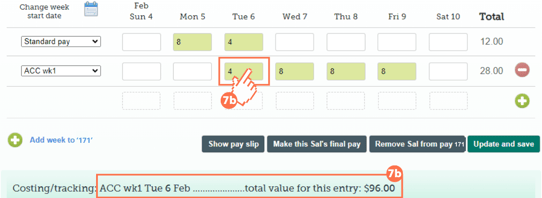

Here is an example of 'ACC wk1' automatically calculating 80% of regular pay:

- The value of the 'Standard Pay' entry of 4 hours is $120.00 (100%)

- The value of the 'ACC wk1' entry of 4 hours is $96.00 (80%)

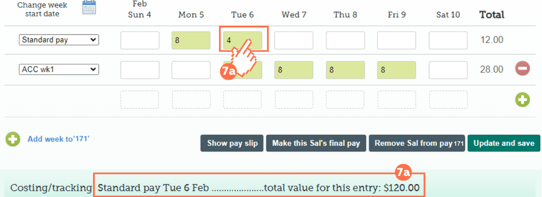

What if I've already paid Sick Leave (or another leave type) before receiving the ACC approval notice?

Often the employer is notified after the fact that the employee has been approved for ACC. Chances are the employee has been on sick leave, another leave type, or receiving standard pay while awaiting their approval. Here's how to update this in our system:

- If the timesheet is still unprocessed on the Pays Dashboard, you can update the entry to 'ACC wk1', delete the other leave row and 'Save'.

- If the pay has already been processed, you have to do a correction pay to correct the sick leave or other leave balance and payment. Follow the guidelines in this article to see what this entails.

Voluntary Top-ups

By agreement, you may choose to top up your employee's pay to 100% while they are on ACC. Using leave entitlements to top-up the pay to 100% does not affect the ACC compensation the employee receives.

Top-ups can be done in several ways. Discuss the options with your employee and agree on the way that best suits you:

-

Paying out a 20% top-up from payroll, without impacting the employee's leave entitlements.

- To top-up 20% during ACC week 1, you have to create a custom pay type for this top-up.

- To top-up 20% from ACC week 2 onwards, use the preset pay type 'ACC wk2+' as shown below.

-

Adding 1 day of their sick leave entitlement to the timesheet for every 5 days of ACC.

During ACC week 1: the timesheet could have ACC days and the leave entitlement you are using to top-up in the timesheet as shown. Remember that 1 leave entitlement top-up is entered for every 5 days of ACC.

During ACC week 2 onwards: you could only have a single day of leave entitlement in the timesheet, as shown below.

-

Adding 1 day of their Family Violence Leave allocation (if applicable) for every 5 days of ACC.

-

Adding 1 day of Annual Leave allocation to the timesheet for every 5 days of ACC.

![]() Top-ups should be taxed as a secondary source of income. Get your employee to check their tax code with the IRD if they are receiving income from both the employer and ACC. You will need to update their tax code in our system.

Top-ups should be taxed as a secondary source of income. Get your employee to check their tax code with the IRD if they are receiving income from both the employer and ACC. You will need to update their tax code in our system.

Payroll during ACC Week 2 Onwards

If ACC is covering the employee's injury, they will pay up to 80% of the employee's average income from the second week of ACC until the employee returns to work. You are under no obligation to top up this employee's pay, which means that they could potentially not have a timesheet to process until their return to work.

|

20% Voluntary Top-up Code from ACC Week 2 onwards. Use the system pay type: 'ACC wk2+' for paying out voluntary top-ups from the second week of ACC until the employee returns to work. This pay type is programmed to pay out 20% of the employee's standard pay, so you don't have to make that calculation yourself. |

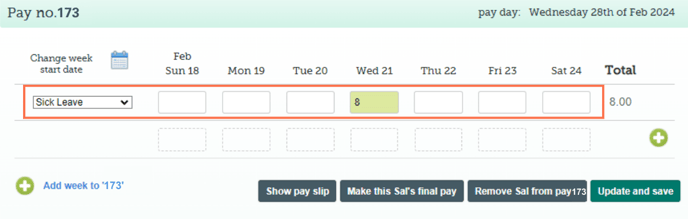

Let's look at adding 'ACC wk2+' to a timesheet:

- Add a new row to the timesheet by clicking the green +sign.

- If your employee is taking the whole week as their second week on ACC, you can simply change the 'Standard pay' pay type to 'ACC wk2+' by selecting this from the dropdown menu of the first row.

- Select the payment type: 'ACC wk2+' from the dropdown menu on the left of this row.

- Fill in the hours for each ACC entry in that row.

- These hours must correspond to the employee's regular hours as set in the 'Default entries' of their Employee Profile.

- Update and Save this timesheet. The timesheet boxes will be green when the timesheet has been saved, as in the example.

- Check the 'Gross balance' for the pay period to ensure that this is correct.

- You can left-click in the timesheet entry field of any timesheet entry to view its Costing Screen.

- ACC wk2+ automatically calculates 20% of regular pay as shown in the costing screen: The value of the 'ACC wk2+' entry of 8 hours for Wednesday is $48.00 (20% of regular pay).

Resources and Further Information

|

What about a Public Holiday within the ACC-recovery time?

|

What if my employee returns for reduced hours while recovering?

To assist your employee in returning to work, they can receive income from both ACC and the employer. This is called abatement.

- In the system, you only pay them for the hours they work at their regular rate. Use the 'Standard pay' pay type and adjust the timesheet hours to match.

- Your employee must confirm with ACC that they've received this income from you and ACC will adjust (abate) their compensation accordingly.

- Get your employee to check their tax code with the IRD, as this could be taxed as a secondary income.

When does ACC stop their compensation?

ACC will stop weekly compensation on the expiration date of the medical certificate, or as soon as a new certificate states the employee is fit to return to work. ACC compensation will also end if the employee returns to work fully before this date.

If you have been topping up the employee's pay, you will need to stop that payment and start paying the employee their full pay again.

Useful links to more information:

The ACC website provides excellent information on coverage and assisting your employee to return to work after an injury. Here are some useful links to get you started:

- What to do when an employee is injured

- How does an employee's income on ACC work?

- Supportig your injured employee to recover at work

So that is the basics for managing payroll for an employee on ACC.

.png?width=688&height=255&name=ACC_SickLeaveTopUp_Timesheet%20(1).png)