8% PAYG in the Casual Employee's Timesheet

8% PAYG is paid in each pay for casual employees. This article will show you how the 8% PAYG works for casual employee timesheets and where this is displayed.

Updated: June 2023

![]() 8% PAYG is not entered manually on a timesheet when included in each pay. The Thankyou Payroll system automatically calculates the 8% PAYG and displays the amount separately in the timesheet.

8% PAYG is not entered manually on a timesheet when included in each pay. The Thankyou Payroll system automatically calculates the 8% PAYG and displays the amount separately in the timesheet.

Filling in a casual employee's timesheet

Casual employees receive their annual leave paid out with each pay. This is called Holiday Pay or PAYG (pay-as-you-go) and is calculated at 8% of Gross income (unless otherwise agreed contractually).

![]() Did you know: 8% PAYG has to be paid on top of the minimum wage in order to be compliant. So if minimum wage is paid, you have to add the 8% PAYG + minimum wage to calculate your casual employee's pay.

Did you know: 8% PAYG has to be paid on top of the minimum wage in order to be compliant. So if minimum wage is paid, you have to add the 8% PAYG + minimum wage to calculate your casual employee's pay.

- For an example of a timesheet where the 8% Holiday Pay is accumulated and paid later such as for Fixed-term Employees, follow this link.

- This timesheet example applies to Casual Employees using the leave setting: '8% of goss earnings (temp and irregular scenario)' with 'Paid into each pay' selected.

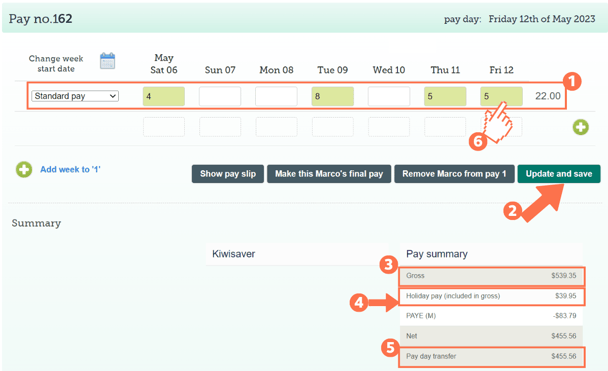

Let's look at a Casual Employee's timesheet example:

The timesheet will be empty as a casual employee doesn't have default work days. Select 'Standard Pay' from the payment type dropdown menu on the left. Now fill in the hours this casual has worked.

Update and Save the timesheet. The timesheet boxes will be green when the timesheet has been saved, as in the example above.

The 'Gross balance' for the timesheet is the hourly rate with the 8% PAYG included.

For this example, the Gross Balance is calculated by adding up the Net balance + 8% PAYG (point 4) = Gross Balance

(22 hours x $22.7 hourly rate) + 39.95 (8% PAYG) = $539.35 Gross balance

The amount of PAYG included in this pay is shown here. To comply with the Holidays Act, PAYG must be an identifiable component of the pay.

The 'Pay day transfer' amount indicates what the employee will receive in their bank account.

To check the Cost Tracking for each separate entry in the timesheet, left-click in the green timesheet box for that entry. You can click in each box to view that entry's cost tracking line.

This is the Cost Tracking line that will display when clicking in the '5' hour entry for Friday 12 May in the saved timesheet. This line shows the value of the wages for this day, without the 8% PAYG.

The 8% PAYG is calculated for the whole timesheet and displayed below the Gross (point 4).

Leave Liability of a Casual Employee

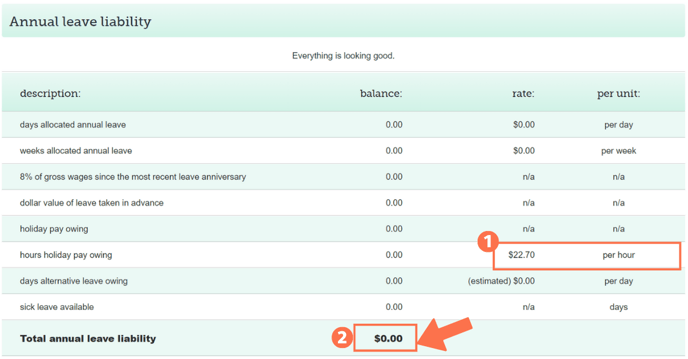

Scroll beneath the timesheet to see the Leave Liability table.

There you will see the following:

- The employee's hourly rate is displayed in the Hours Holiday Pay Owing line, but the balances should be 0 as a casual employee does not accumulate annual leave.

- Side note: There could be a balance for Sick leave available if your casual employee has met the minimum requirements for sick leave. This does not impact Annual Leave Liability. To find out more on sick leave for a casual employee, follow this link.

- The Total Annual Leave Liability of a casual employee should be $0. If this is not the case, please get in touch with our Customer Success Team.

That is it! You have now successfully loaded your casual employee's timesheet.